Excise Tax: The Ultimate Guide for Small Businesses

As a small business owner, you know taxes can be one of the most complex and confusing aspects of running a business. That’s why it’s important to have an understanding of the different types of taxes and how they apply to your business. One type of tax that all businesses should be aware of is excise tax. Excise taxes are taxes levied on specific goods or services, such as cigarettes and alcohol, that are typically considered “luxury items”. In this guide, we will discuss what excise tax is and how it affects small businesses. We’ll also provide some tips for managing your excise taxes effectively so you can stay compliant and maximize your profits.

User Navigation

In this article, you will learn what the Excise Tax is and what it means for your business. We would also tell you how the Excise Tax is calculated and what this tax is used for.

An excise tax is a tax levied on items that are often deemed either luxury goods /services or socially harmful. Alcohol, gas, luxury vehicles, indoor tanning, airline tickets etc are subject to this tax. Excise tax is also termed a “sin tax” because it is imposed on goods/services that are regarded as unhealthy and this tax contributes billions of dollars to the state and federal revenue every year.

Excise tax is also designed to help discourage the use of potentially harmful services and products as these are taxed at a rate much higher than that of other non-harmful services and products. According to a recent study by the International Agency for Research on Cancer, the overall tobacco consumption has been reduced considerably, thanks to the increase in excise taxes and a resulting increase in prices of tobacco products.

Read More-: Can I Print W2s From Sage 50 without Subscription

Here is a list of items (but not limited to) that invite an excise tax –

- Alcohol.

- Tobacco

- Recreational marijuana

- Vaping and e-cigarettes.

- Sports betting

- Medical marijuana.

- Indoor tanning

- Vehicles

- Gambling.

- Air transportation

- Ammunition

- Fuel (including gas).

- Firearms

Is it Mandatory for a Business to Pay the Excise Tax?

It is mandatory for your business to pay the excise tax if you are selling certain items or services. Also, based on the location of your business, you may need to pay various local or state excise taxes, apart from the federal excise taxes applicable all over the country.

If you sell tobacco, alcohol or firearms, you need to register with the Alcohol and Tobacco TTB (Tax and Trade Bureau). Businesses selling other products or services that are subject to excise tax need to deal directly with the IRS. For some other products subject to excise tax, you need to register, before you are allowed to sell them. As per the IRS, any failure to register these products before selling will attract a penalty of $10,000 for every initial failure, in addition to $1,000 per day thereafter. Please note that this fine will be over and above any other tax you owe at the time.

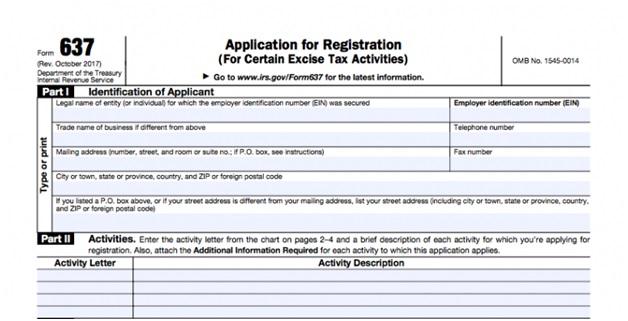

You will need to fill in your details in Form 637, to register with the IRS. Then you should submit it to the IRS via fax or mail. Once your application is approved by the IRS, you will be sent a registration letter. You can also check your registration status with the IRS online. Form 637 looks like as shown below-

How is the Excise Tax Calculated?

An excise tax is calculated in two ways -ad valorem or specific. In ad valorem, the tax is considered as a set percentage. This means a business will need to pay a definite percentage of the sale made by it. For example, the excise tax rate levied on indoor tanning services is 10% and as per the IRS rules, the provider should collect it when the purchaser makes the purchase. Therefore, if the tanning provider charges $10 for a tanning session, the excise tax will be $1 and the total bill of the customer will be $11.

On the other hand, a specific tax is a set amount levied on a particular good. For example, the federal excise tax imposed on a pack of cigarettes is $1.01. the states also have their own versions of excise taxes on cigarettes and the customers need to pay this in addition to the federal excise tax. At present, Connecticut charges the highest excise tax on a pack of cigarettes. it levies a state excise tax of $4.35 per pack, apart from the federal excise tax, as applicable.

When do You Need to Pay the Excise Tax?

You need to pay the federal excise taxes on a quarterly basis. This tax is due a month after the expiry of a quarter. To file for the excise tax, you need to submit the filled Form 720 by mail or otherwise to the IRS before the due date. You can also file this form online. For the online submission, you will need to pay the service fee determined by the provider determines. However, please note that you can’t file all the excise tax forms electronically. Some tax forms are required to be submitted physically. According to the IRS, the following Forms can be filed electronically-

- Heavy Highway Vehicle Use Tax Form 2290

- Form 720

- Quarterly Federal Excise Tax

- Form 8849

- Claim for Refund of Excise Taxes (Schedules 1, 2, 3, 5, 6 and 8)

The different state and local excise taxes have their own schedules and due dates. Their due dates may or may not match with the federal excise tax due dates. Therefore, make sure to check the due dates of different excise taxes your business need to pay and make sure you pay them on time. The due dates for the excise taxes owed by a business to the Alcohol and Tobacco TTB comply with a different schedule altogether. Some businesses need to file this tax annually, while some others need to file quarterly or semi-monthly, based on the type of goods /services sold. To give you an example, firearms, ammunition and indoor tanning services need quarterly federal excise tax returns. The complete list of due dates is available online, along with the prescribed frequency of filing- specific to different types of businesses.

Also Read-: 2021-2022 Capital Gains Tax Rates

Final Words:

In conclusion, excise taxes are a major part of the tax system and can be difficult to navigate. For small businesses, it is important to understand the various types of excise taxes that may apply and how they affect your business’s bottom line. Having an understanding of these taxes will help you plan ahead for any potential payments due and avoid potentially costly mistakes down the road. Be sure to consult with a qualified tax professional on our tollfree number 1800 964 3096 if you have any further questions or concerns regarding excise taxes.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

💠Frequently Asked Questions💠

Do you Need to Inform your Customers about being Charged an Excise Tax?

Some business owners opt to inform their customers that excise taxes are included in the price of the services or goods they are purchasing. When the tax was added on indoor tanning as part of the Affordable Care Act, some indoor tanning providers opted to inform customers about this, to justify the resulting increase in prices at their businesses.

However, some business owners choose not to disclose this piece of information to the customers. They simply include the excise tax on the cost of items while fixing the price of their goods or services.

What is the Difference between an Excise Tax and a Sales Tax?

Both these taxes are very much similar. However, one notable difference is that the excise tax is levied on the sale of certain specific items. On the other hand, the sales tax is levied on almost all the items bought by a customer or sold by a small-business owner. Another difference may be-the sales tax is always a certain percentage of the purchase amount, which is not always the case with the excise tax.

What is the Money Collected from Excise Taxes used for?

The money collected from excise taxes is usually sent to a general fund. It is also earmarked for certain trust funds. Excise taxes cover about 3%, of the federal revenue every year. In general, these taxes are used to generate funds for efforts and programs benefitting people in the country. They are also used to foster positive improvements such as road maintenance and repairs.