Where is Accounts Payable in Sage 50 2015 for 1099 Correction

Do you dread tax season because it means dealing with 1099 corrections? Sage 50 2015 has got your back when it comes to handling all things AP and correcting those pesky 1099 forms. In this blog post, we’ll dive into the ins and outs of using Sage 50 for seamless accounts payable management, including how to easily make any necessary corrections on your 1099s.

User Navigation

- What is the 1099 Form?

- 2 Steps Solution to Accounts Payable in Sage 50 2015 for 1099 Correction?

- How to Reprint Completed 1099s

- When the eFile or Print is Incomplete in 1099s

- How to Rectify When a Vendor has Received two 1099s forms, Where one EIN is Correct and the other is Incorrect?

- Accounting Professionals & Specialized Experts

- 💠Frequently Asked Questions💠

Sage 50 is one of the most trusted accounting and financial software out there? It has been recommended for both small and large-sized businesses in order to efficiently accomplish various accounting-related tasks in a jiffy. Some of the most important features include cash flow management, Inventory management, Payment acceptance and Invoicing, and Sales optimization, among others. Nevertheless, despite its remarkable features, this software has its own share of glitches. In this article, we will try and understand where is accounts payable in sage 50 2015 for 1099 correction. But first, let us understand a bit about the ‘1099 forms’ and what makes them special.

What is the 1099 Form?

To start with, the 1099 form is applicable in reporting a specific type of non-employment income to the Internal Revenue Service. It is effective in the case of some non-employment income as in the case of freelancers or independent contract workers. As in the case of the 1099 process in Sage 50, it is quite simple and easy to execute. The transactions that Sage 50 includes on 1099 are generally payments to vendors. In this case, any sort of adjustments needs to be done in a manner that it does not alter or create any variations in the General Ledger balances or lead to any interference with the bank reconciliations. Interestingly there are quite a few varieties of the 1099 forms as well.

Let us take a brief look into each of these:

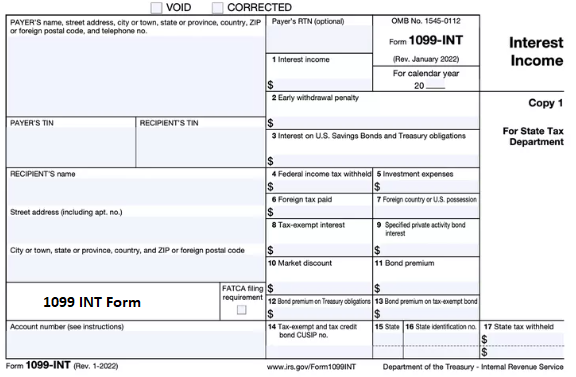

1099-INT

Is relevant for taxpayers if their earnings exceed more than $10 of interest in the tax year. This is applicable to brokerage firms, banks and various other investments.

1099-DIV

This is relevant for the taxpayer in case the dividend income is earned throughout the tax year.

1099-G

This form type is sent in case the money has been received from the state, federal and local governments.

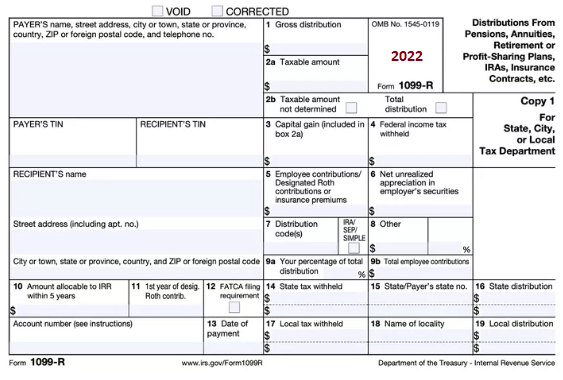

1099-R

This is issued in case a taxpayer receives a distribution of payouts from retirement plans, pensions, or Individual Retirement Accounts.

1099-B

This is for the taxpayers who comprise various transactions from brokers as in the case of the Sale of stocks, and other securities and commodities. Another transaction that can be included in this type is bartering which is executed through a barter exchange.

1099-S

This is in the case of taxpayers for real estate transactions when and if a sale or an exchange has been done during the tax year.

Now, that we have taken a look at each type of ‘1099 form’ let us get into understanding.

Read More-: Process for efiling my 1099s and 1096s in Sage 50

2 Steps Solution to Accounts Payable in Sage 50 2015 for 1099 Correction?

Note: it is mandatory that the user should be in the applicable Company Code that originally print the 1099 forms.

Solution 1:

- Launch accounts payable, Form 1099 efiling and reporting

- Click on New

- Now, select the 1099 form type you require to make corrections at: Misc/NEC/Div/int

- Check and verify if the tax year has been entered correctly

- Hit on Accept

- Click Continue in case you receive the following statement: The selected reporting period is for year xxxx, but this for is for year xxxx. If you continue, your reports may be inaccurate. Are you sure you want to continue?”

Solution 2:

- Launch Accounts Payable, Reports, Form 1099 efiling and Reporting

- Click on History to activate a drop-down menu list

- Hit on Accept

- Click tick the check box next to ‘Applicable 1099 Filing’

- Click on Edit option

- You are done

While performing the above solution, you must bear in mind that the History File option emerges after a minimum of one part of the Sage 1099 efile has been processed. The final completed action table displays the latest action and the date on which the action was performed for every 1099 copy type. Also, every time a certain action has been completed on the 1099 Wizard, the program once again returns back to the History File Options screen.

How to Reprint Completed 1099s

This is the action one needs to comply with once the reprinting of the 1099s using the 1099 wizard has been done. So, where is the reprinting action required? Well, this is applicable, for example, if a copy has been lost by one of the recipients, one can use the ‘Reprint Completed 1099s’ option to be able to acquire an extra copy. Once the processing has been accomplished, while entering the 1099 wizard, the 1099 History File Options Dialog will emerge.

Now, follow the below steps to be able to reprint the Completed 1099s:

- Click on the ‘Reprint Completed 1099s’

- Ensure that the Radio button to this option has been clicked

- Now click on the ‘Next’ option located at the bottom of the dialogue box

- A Reprint Option will emerge

- As it is possible to reprint the 1099 type after the ‘processing’ a few options will not be visible

- Now, you can reprint multiple 1099s types at once by simply checking the boxes against each type that needs to be reprinted.

When the eFile or Print is Incomplete in 1099s

There are times when the additional 1099 copies have not been processed. For instance, the 1099 wizard has printed the recipient copies but now you need to eFile the Federal and the State copies. However, the application of eFile or Print Incomplete 1099s action does not enable corrections to be completed in this case. Here the additional 1099 copies will utilise the same data as from the previous 1099 filing. Go to the ‘History File Options’ and go to Correct Complete 1099s in case you need to change the information before the additional filings are sent.

- Go to the History File Options on the screen

- Click on eFile or Print Incomplete 1099s

- Click Next

- Now, select how to process the additional filing

- Click on the state for which 1099s are to be processed

- Browses the Action list

- At this point you will get the FormsViewer that will display the forms that need to be printed or eFiled according to the Processing options offered.

One has to bear in mind that available options on Filing options and Printing screen will remain limited according to the copies that have already been created.

Read also: Access 1099 NEC form Files for Use with Sage Checks Forms

How to Rectify When a Vendor has Received two 1099s forms, Where one EIN is Correct and the other is Incorrect?

There are two distinct choices available in this case.

- Add the Amount/Amounts From the bad EIN Vendor to the good EIN vendor line

- Delete altogether the bad EIN vendor line. This can be done by right-clicking on the row number and clicking on Delete.

If you select any of the above two options, then two rectified 1099s forms will be sent over to the respective recipients. This includes one with the combined amounts and the other one with zero dollars and the bad EIN. In this case, the grid will contain one less of the total recipient count; however the total number of 1099s that have been processed will also comprise the one deleted and the rectified one will be sent to the recipient accordingly.

In case any of the above does not helps, then you can go ahead with this below solution:

Change the EIN on the Bad EIN Vendor and Leave It.

When applying the above option, only one rectified 1099s form will be sent to the recipient. However, the user can file multiple pay vendor 1099s or the same EIN recipients.

How to Correct the Completed 1099s

This action allows the corrections to be conducted on the 1099s copies that have already been processed. As the user proceeds to select the Correct Completed 1099s actions. At this point, the 1099 Preparer will emerge, wherein it will be required to make the relevant changes to the data. The corrections to the 1099 Preparer that need to be done will be conducted by the 1099s wizard with the help of the previous action information. For instance, in case the Federal 1099 copies have already been efiled, but, the eFile center has already submitted the Federal 1099 copies over to the agency, the rectified copies will be displayed by the Forms Viewer that the user needs to print out or mail it to the Federal agency.

How to Make Corrections to the 1099s that have Already been Filed or Mailed? / How to add or Delete 1099s from the Filings that have been Previously eFiled or Mailed.

To do so, you will need to follow the below steps:

- Go to the Correct Completed 1099s

- Click on Next.

- Go to the W2/1099 Preparer window and conduct the required rectifications on the 1099s recipients.

- You will notice that all the cells that have changed will appear with Blue text

- The Row number will be visible in Green for every Vendor that has changed by you.

- Click Next step after you have made the corrections.

- Right-click on the Nmbererd column and select Insert to include a Row. This will add a 1099s recipient

- Next, select the number of rows you need to add.

- One row for each vendor should be inserted

- Add all the relevant details as asked

- To Delete a Recipient, go to the numbered row and right click on it and select Delete

- The above step can also be done manually, by zeroing out any Dollar amounts in the right boxes

- The above changes done on the 1099s will automatically create a ‘corrected’ checked box.

- Hit on Next as soon as all the changes have been made

- Here you will be prompted by the wizard to verify FEIN, Federal and State tax withheld and Filing state is correct

- In case any previous 1099s have been printed a correction options dialogue box will be displayed

- At this point you will have to select on Yes or No if the copies have been mailed

- ‘Do you want to print Divider sheets?’ Click on Yes or No accordingly.

- Click on Next

- Click Print and Hit on Next if you wish to print a copy of ‘Actions that will be taken’

- At this point you will be prompted by the wizard to review and print all your forms and the changes made on them.

- This can be done with the help of the FormsViewer

- In case you need to eFile the corrections, this can be done through the eFile wizard once again. Use your username and password to do so.

- As soon as this is done, you will be taken back to the 1099 Wizard window

- Close once done.

Also Read-: How to Print 1096 Forms for 1099 Vendors in Sage 50

CONCLUSION!

So, there you have it, people. These are some of the best-known solutions when dealing with ‘Where is accounts payable in sage 50 2015 for 1099 correction’. Be sure to create the appropriate backup before you embark on the solutions part of the issue. However, if you still continue to encounter problems, be sure to reach out 1800 964 3096 to us and our team of experts will be more than happy to help you out. Visit here Accountingadvice.co.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

💠Frequently Asked Questions💠

How Does One Edit 1099?

The process of editing 1099 is actually quite simple. All you need to do is fill out the correct 1099 form and include the previous copy along with the new one as you mail them out. For this, you need to click tick on the ‘Corrected box’ on top of the form 1099. This allows the IRS to know that the forms have been rectified.

How to Align 1099?

To do so, you will have to:

🔹 Open the File

🔹 Click on Printer Setup

🔹 Set the form name to 1099s/1096

🔹 Set up the correct printer type

🔹 Hit on the Align option and type in the right align values

🔹 Hit OK

🔹 You are done

What is the Meaning of the Corrected 1099?

The 1099 form is an informational tax form that has been filed with Internal Revenue Service IRS. This is to be able to report specific types of payments. In case an error has been filed the information needs to be rectified and submitted over to the appropriate federal and state agencies.