Sage 50 Bank Reconciliation Discrepancy

To confirm the accuracy of the account, every organization and user needs to use the Bank reconciliation feature within the accounting software. The process has been designed to reduce the difference between the statement and bank transactions. Once the transaction matches, the differences between them should be zero. If the difference is not zero, then it is nothing but this process is also known as a discrepancy. At this point, in case it is not found to be zero then you should look for fixation methods of Sage 50 bank reconciliation discrepancy. This entire troubleshooting solution is explained in this blog. Let us take a look at the various Sage 50 bank Reconciliation discrepancy problems and their significant causes.

User Navigation

Here we go!

What is Meant by Sage 50 Bank Reconciliation Discrepancy?

Sage 50 Bank Reconciliation Discrepancy is essentially a program that has been developed to help accountants find and fix several bank reconciliation errors in Sage that usually occur during the process of tax preparation. You need to know that the Bank reconciliation statements are financial documents that summarize your bank account activity as well as the internally recorded activities. These demonstrate that both the records are consistent with each other, and are used to reconcile your bank accounts.

After the bank account balance within the books of account has completely matched the amount reported by the financial institution in the most recent bank statement, this process is known as bank reconciliation according to accounting standards. In case of the existence of a difference between both data should be detected as soon as possible, and, if required, it needs to be corrected as well.

Read More-: Bank Feeds Common Error Codes

State some of the most important aspects to keep in mind about the Sage 50 Bank Reconciliation Discrepancy.

- Bank Reconciliation is all about determining whether the account records and bank details agree.

- After the discrepancy and/or an unresolved amount have been identified, the required time must be spent to determine their origin.

- There are no bank reconciliation analysis services or fast fixes available through Sage Consultant.

- Sage is not able to decide which entries need to be present within your company’s books or which transactions need to be reported in your bank statement.

What Are the main Reasons that Lead to Sage 50 Bank Reconciliation Discrepancy?

The discrepancy can occur due to various reconciliation adjustments like journal entries, and added, modified, or deleted reconciled transactions. The main reasons are that past reconciled transactions have been added, deleted, or altered or reconciliation arrangement. Hence you have faced issues while Reconciling the Sage 50 Bank Statement.

How can we avoid the Sage 50 Bank Reconciliation Discrepancy?

Please note that Sage Support does not provide any bank reconciliation analysis services. Also, it is not at all possible for Sage to assess what entries should exist (or what not) in your company books. It has no method of knowing what should be posted to your bank statement. If you encounter a discrepancy and/or have an unresolved amount, you need to spend a fair bit of time investigating the source of the error. You can make the following checks to determine the usual sources of bank reconciliation discrepancies so that such errors can be avoided. Making a thorough check on the following points would help-

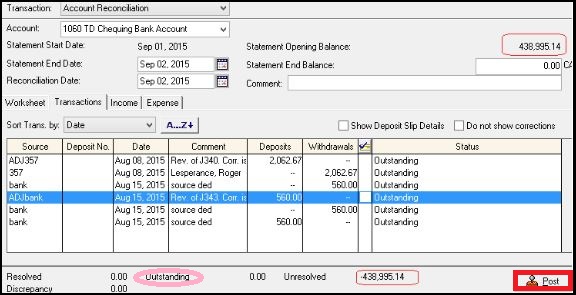

Whether you have entered the following correctly:

- Statement Start Date

- Statement End Date

- Statement Opening Balance

- Statement Ending Balance

- If all the transactions mentioned in your bank statement were recorded in Sage 50

- If all the transactions are dated correctly

- Whether your bank account linked to Sage 50 has the correct book balance

- If you have cleared all the transactions appearing in your bank statement

- If the gains (interest, exchange, errors) are added to the Income tax (if applicable)

- If the bank fees were added in the Expense tab (if applicable)

- Go to the Reconciliation window and check if the Outstanding amount matches with the total of all the unchecked items

- If not, you will need to reset the reconciliation

Also Read-: Troubleshoot Sage 50 Account Out of Balance Error

Final Words

We hope the discussion above would help you stay away from and fix the Sage 50 Bank Reconciliation Discrepancies with ease. If you are having difficulty while executing the steps shown above or, are still unable to resolve the issue, we recommend speaking with some experienced Sage professionals.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

Frequently Asked Questions(FAQs)

How can I Clear a Bank Reconciliation in Sage 50?

Here are the steps to clear a Bank Reconciliation in Sage 50–

🔹 Double-click on the Chart of Accounts tab

🔹 Double-click on your bank account

🔹 Now, click on the Reconciliation & Deposits tab

🔹 Next, uncheck the box adjacent to Save Transactions for Account Reconciliation

🔹 Click on Save and close to close the account

🔹 Select OK in order to remove the entire reconciliation information

How can I Enable Bank Reconciliation in Sage 50?

Here are the steps to enable Bank Reconciliation in Sage 50–

🔹 Open the Sage 50 application

🔹 Go to the Home window:

🔹 If you have enabled the Enhanced View, go to Company and double-click on the Chart of Accounts tab

🔹 In case you are in Classic View, double-click on Chart of Accounts

🔹 Now, make a double-click on your bank account

🔹 Click on the Reconciliation & Deposits tab

🔹 Next, checkmark the box adjacent to Save Transactions For Account Reconciliation

🔹 The Set Up button will be displayed at the bottom of the page

Click on it and set up the revenue accounts for the following:

🔹 Adjustments

🔹 Exchange gain

🔹 Interest income

🔹 Error-Gain

You can also set up expense accounts for –

🔹 Interest Expense

🔹 Bank charges

🔹 NSF Fee, and

🔹 If needed, you can also rename the types of Interest and Expenses shown in the bank statement.

🔹 Click OK to save your settings

What is the Procedure to Set Up a Credit Line Bank Account in Sage 50

You can simply set up a credit line account just like any other bank account. You can then name it accordingly.

Please follow the steps below-

🔹 Navigate to Chart of Accounts

🔹 Create a new bank account

🔹 Make sure to keep the Account Class as Bank.

🔹 Mark the Account as a Credit line account.

🔹 You may also select to make regular payments from this account

If you want to transfer money between this account and other bank accounts, follow the steps below-

🔹 Click on the Banking tab

🔹 Click the tab named Transfer funds.

🔹 You can click on the Transfer from /Transfer to bank name as you require

🔹 Enter the amount as desired.

🔹 Click on Process.

Please Note: this asset account will most likely show a negative value

How to Make an Account Inactive in Sage 50?

Here are the steps to make an Account inactive in Sage 50–

🔹 Go to the Maintain menu

🔹 Click on Chart of Accounts. The Maintain Chart of Accounts window will appear on your screen

🔹 Enter or choose the specific account ID to make inactive

🔹 To locate the list of existing accounts, click on the G/L Account ID field and type ?. Alternately, you may click on the Lookup button

🔹 Finally, click the Inactive check box adjacent to the selected account ID