How to Manage Employee Record Information in Sage 50?

With its amazing features, Sage 50 has helped businesses perform their accounting and bookkeeping functions with desired efficiency. Sage 50 also helps businesses to manage their employee records better. They can keep a better track of matters related to their employees and generate useful reports with just a few clicks. These comprehensive reports can be used by the management to formulate future strategies.

Are you yet to create and manage employee records in Sage 50? You are definitely missing something! But don’t bother! We have it covered for you! Just go through this blog. Here, we will tell you from scratch, about how to manage employee record information in Sage 50 and other related matters.

Here we go!

First things first! Let’s get to know how to add records in Sage 50. This will make you ready to record employee transactions.

How to Add an Employee Record in Sage 50?

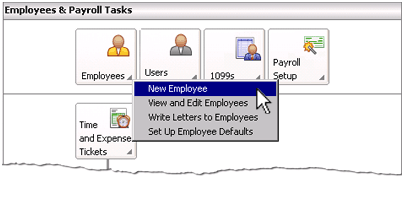

- Visit the Employees & Payroll Navigation Center.

- Click the Employees icon

- Now select New Employees from the drop-down list appearing on your screen.

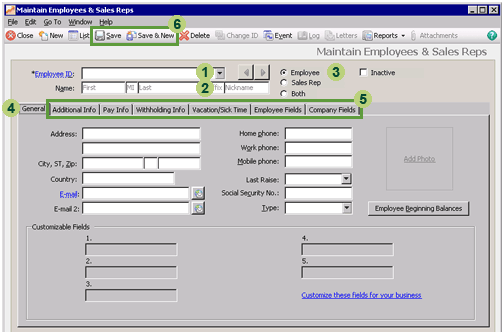

- The Maintain Employees & Sales Reps window will open up. Here, you will need to enter the relevant details of your employees

Here is a list of important tabs and fields in this window. We have also mentioned the actions need to be taken for entering details in each field.

|

Sage 50 Field /Tab |

Action |

|

Employee ID |

Enter an identification code for the employee. |

|

Name |

Fill in the employee name |

|

Employee type |

Select the appropriate employee type. |

|

General tab |

Make sure to select the General tab. Now enter information about that particular employee into the relevant fields. |

|

Other tabs |

Enter the required information in the other tabs ( as shown in the rows below) |

|

Additional Info tab |

Enter emergency contact, employment details and demographic information |

|

Pay Info tab |

In this tab, you can specify if the employee is paid salaries or wages and other details related to their pay rates and pay frequency. |

|

Withholding Info tab |

In this tab, you can record details like amounts to be kept withheld from the pay due to the employee. |

|

Vacation/Sick Time tab |

Here, you can record vacation and sick time policies related to the employee. |

|

Employee Fields tab |

You can click this tab to view the deductions and withholding taxes applicable for that employee. |

|

Company Fields tab |

You can click this tab to view details such as payroll taxes and contributions the business needs to pay for the employee as employers contribution. |

- Once you complete entering the information relevant to the employee, make sure to review your entries

- On being satisfied, click Save. If you need to enter the record for another employee, click Save & New

Related article: How to Setup and Pay Employees in Sage Software

How to Modify an Employee Record in Sage 50?

Here are the steps to modify the existing record for an employee-

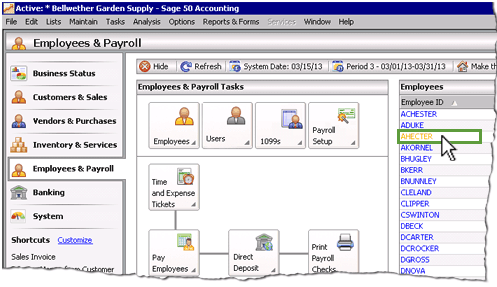

- Visit the Employees & Payroll Navigation Center.

- Visit the Employees list on the right hand side of the window

- From the employee IDs appearing in the list, select the Id of the employee whose record you want to modify

- Open the Maintain Employees & Sales Reps window for that particular employee

- Make the changes desired

- Click Save

How to Delete an Existing Employee Record in Sage 50?

Here are the steps to delete the existing record for an employee-

- Visit the Employees & Payroll Navigation Center.

- Visit the Employees list on the right hand side of the window

- From the employee IDs appearing in the list, select the Id of the employee whose record you want to delete

- Open the Maintain Employees & Sales Reps window for that particular employee

- Click the Delete icon

- A prompt will appear on your screen, asking you ‘Are you sure you want to delete this record?’

- Click Yes to delete the employee record

“Please note: You will not be able to delete the existing record of an employee record if any transaction has been applied to that particular employee”.

Our Support:

We hope the sequential steps mentioned above would help you a great deal to better manage employee information in Sage 50 . If you are still facing any difficulties in carrying out the above-mentioned steps, you may speak tollfree 1800 964 3096 to our experts, anytime you want.

🔔 Frequently Asked Questions

Q1. What are the Methods to Record Employee Expenses in Sage 50?

Ans: Reimbursing employee expenses is a routine activity for many businesses. There are 2 ways how you can do so in Sage 50. Some employers prefer to add expenses to the employee’s net wages. Some others reimburse expenses separately. In Sage 50, you can record employee expenses in both these ways-

➤ If you wish to add the expenses to the net wages of an employee, you can record the expenses through journals.

➤ If you want to reimburse him separately, you can set up the employee as a bank account in Sage 50

Q2. Is it Easy to Upgrade from Sage 50 to Sage 100?

Ans: Yes. Upgrading or migrating from Sage 50 to Sage 100 is fairly easy. Sage 100 is a true ERP system and if you need more functionality to match your business growth, it has more to offer you. However, for smooth migration from Sage 50 to Sage 100, you should keep the following points in mind –

➤ Set clear objectives and scopes before deploying the software up gradation process

➤ Put together a dedicated team to oversee the Sage 100 implementation

➤ Opt for a phased approach. Divide the up gradation in to well-defined & logical sections

Q3. What type of companies is Sage 50 more useful for?

Ans: Sage 50 is considered more useful for comparatively smaller companies that do not expect an influx of over 10 users at a particular point in time.