Sage 50 Peachtree 1099 E-File

For those who are using Sage 50 Peachtree to manage their accounting, the process of 1099 E-Filing can be a complicated endeavor. With all the forms and reports that need to be filled out, mistakes can easily be made. Unfortunately, if errors do occur in the filing process, it can result in hefty fees and penalties from the IRS. That’s why it’s important to know how to fix your mistakes quickly and accurately. In this blog post, we will explore some tips and tricks on how to repair Sage 50 Peachtree 1099 E-File issues so you don’t have to worry about any additional costs down the line.

User Navigation

The Sage software is unwavering on its path of garnering appreciation for its excellent features and tools from one and all in the accounting world. It not only makes tasks more streamlined for different business domains but also enhances the growth pattern with its various characteristics. Tax filing times are coming up and this software can play a prominent part in helping you do it smoothly.

Related article: How to Print 1096/1099 Forms in Sage 50

An individual who is not from the financial and accounting background can also interpret this software while working on it. However, during the taxation time all Sage users are preoccupied with completing and e-filing 1099 Form in Sage 50 in the exact way.

Some of the Types of 1099 Form are:

- 1099 MISC Forms: Miscellaneous Income.

- 1099 K: Merchant Card and Third Party Network Payments.

- 1099-INT Forms : Interest Income.

- 1099-DIV Forms : Dividends and Distributions.

- 1099-R Forms : Distributions From Pensions, Annuities, Retirement, etc.

- 1098-T Forms : Tuition Statement.

- 1099-B Forms : Proceeds From Broker and Barter Exchange Transactions.

- 1099-PATR Forms : Taxable Distributions Received From Cooperatives.

- 1099-OID Forms : Original Issue Discount.

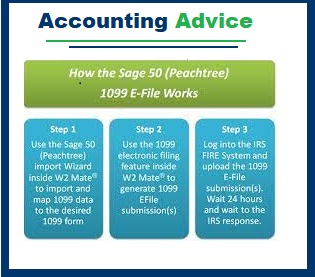

It is advisable to take guidance from from Sage drilled adept executives who can assist in every way. Get in touch with the Accounting Advice experts. Their toll free number is. They will at once offer you with the resolutions so that you can be tension-free during the taxation time. Few software have the dedicated 1099 import functionality for Sage 50 (formerly Peachtree). It can remap data to different types of 1099 forms. Steps to do it are:

- Use the Sage 50 (formerly Peachtree) import Wizard inside such a software to import and map 1099 data to the desired 1099 form.

- Use the 1099 electronic filing feature to render 1099 E File submission.

- The user needs to log on to the IRS FIRE System and upload the 1099 E-File submission. Then there is 24 hours waiting time; wait for the IRS response.

Also Read: How do I access 1099-NEC form files for use with Sage Checks & Forms?

There are more steps in e-filing of 1099 form. To complete them in an accurate way, get in touch with the Sage tech support team at Accounting Advice. You will be happy by the fast resolutions and step by step guidance.

Procedure to do E-filing in Sage 50

Method 1: Select the Proper E-Filing Form

- Click on Employees & Payroll

- Go to Forms

- Select either Federal Forms or Reports & Forms,

- Now click on Tax Forms.

- Double-click on the Payroll Tax Forms tab

- Navigate to the Available Forms section and choose the [Year] 1099-INT[Year] or 1099–MISC

- Set the Filing period as Yearly,

- Choose the correct year

- Click OK to proceed

- The 1099 Setup Wizard window will appear on your screen

- Select your preferred option,

- Click Next to proceed

Method 2: Verify the Information

- Check if the Payer Identification Number is correct

- Select the correct EIN or SSN

- Click Next.

- Check the Payer information

- Click Next to proceed

- Select the proper Tax Prepare Type

- Click Next

- The Third-Party Prepare Information window will open up

- Type in the details in appropriate fields,

- Click Next to proceed

- Verify if each of the State and Locality authority/item is correct,

- Click on Next.

- Choose appropriate options on Data Verification window

- Click Next.

- Choose your preferred options on the Recipient Identification Numbers window

- Click Next.

- Choose your preferred options on the Multiple Data Files window

- Click Next.

Please Note: If you clicked Yes to multiple 1099 data files you will need to complete the merge process. When completed, proceed to the next step.

- The W2/1099 Preparer worksheet will appear

- Check if the information highlighted in blue is correct

- Click on the Next Step tab

- Proceed to check the highlighted information

- Click on Next Step till the 1099 Printing and Filing Options window comes up

Method 3: E-file and/or Print the 1099s

- Select either Select My Own Options or Complete 1099 e-filing Service.

Please Note: In case you subscribe to the 1099 e-filing service, you will be able to e-file the 1096 and 1099 Federal Forms. If you want the recipients to get the 1099s electronically, you will incur additional charge.

- For printing the forms click on Select My Own Options

- Now select the forms you need to print

- Click Next to proceed

- Check the selections you made from the previous page

- Click Next.

- Choose your preferred option for divider sheets

- Click Next.

- Click Next to Review Data.

- From the top, click on the Next Step tab

- Click OK.

- Click on Next Step. Repeat this process to review all the forms.

- If you selected the e-file option, the Aatrix Secure e-file window will come up on your screen.

- Follow the on-screen instructions to finish the process.

Read More: Sage 50 Payroll Tax Calculation Could not be Found

Final Words!

The Accounting Advice is a Sage technical support team of knowledgeable experts who can help in e-filing 1099 in Sage 50 in the correct way. These highly trained professionals of the Sage tech support team are available round the year at anytime of the day or night to guide you step by step so that you can enjoy a peaceful time after e-filing during the taxation time. They are experienced and can tell more about the software too. The toll free number 1800 964 3096 to reach Sage customer care number of Accounting Advice.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

💠Frequently Asked Questions💠

How to Print or E-File the State Quarterly Forms?

🔷 Go to the Reports and Forms menu,

🔷 select Forms

🔷 Click Tax Forms.

🔷 The Select a Report or Form window will appear on your screen

🔷 Double-click on the Payroll Tax Forms tab

🔷 Click on the State form type

🔷 Select your state.

🔷 Highlight the state for which you need to print or e-file.

🔷 Go to the select filing period section and select the year and quarter

Please Note: If you select a new form, you should again select the year and quarter you prefer.

🔷 Click OK

🔷 Follow the instructions appearing on your screen

How to Print or E-file the 941/941B Federal Tax Forms?

🔷 Go to the Reports and Forms menu

🔷 Select Forms

🔷 Go to the Tax Forms.

🔷 The Select a Report or Form window will appear on your screen

🔷 Double-click on the Payroll Tax Forms tab

🔷 In the Available Forms box, select the current 941/Schedule B/941-V Report.

🔷 Go to the select filing period section and select the year

Please Note: If you select a new form, you should again select the year you prefer.

🔷 Click OK

🔷 Follow the instructions appearing on your screen