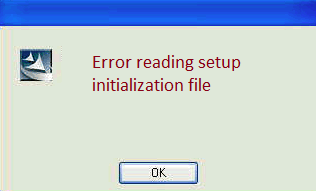

Sage Error “Reading Setup Initialization File” when opening Payroll Tax Forms

A common issue that arises when opening certain pay stub or payroll tax forms is the error “reading setup initialization file”. This error typically occurs when you are trying to open a form that was saved on a previous computer and saved with a different name (such as “.xls”). The solution to this problem is relatively simple. Simply rename the file before opening it.If you don’t have access to the file or if you are having difficulty saving the file. Know how to fix this issue.

User Navigation

Sage is one of the leading financial software that has been specifically designed to assist in the accounting requirement of various businesses. The best part about Sage is that it is applicable and suitable for the business needs of both small-scale and large-scale firms. Being one of the most sought-after software world over, Sage has emerged to be a winner that caters to the various needs on the financial spectrum of a business, with ease.

However, much like everything else, it is not free from its own set of glitches. The Sage Error: “reading setup initialization file” when opening payroll tax forms is one such issue that one often encounters when using the Sage software. But first, let us understand a bit about the Sage Payroll Tax forms and how it is efficient for business requirements.

The Sage Payroll Tax Form Selector

This feature of the software has been designed to be able to print federal and state tax forms on plain paper. The current payroll tax forms can be generated based on the Sage 50 2022 Payroll Tax company data. One can easily edit and enter data and later print the forms on plain paper for signatures and verifications and assign them to the relevant tax authorities. When one encounters the Sage Error: “reading setup initialization file” when opening payroll tax forms, it can be resolved nonetheless. So how is this done?

Read More-: Form 941 not Opening in Sage 50

Solutions for Sage Error ”Reading Setup Initialization File” when opening Payroll Tax Forms

Solution 1: To Disable the Firewall or Anti-Virus

To do this, you will have to:

- Disable the Firewall and Anti-virus temporarily

- Open up the tax forms and verify for the updates to complete

Solution 2: Is the Compatibility Mode Checked?

To do this you will have to:

- Close the programs

- Go to the program icon and right-click on it

- Click select Properties

- Click to select the Compatibility mode, uncheck the Run in this program in compatibility mode for

- Click on Apply

- Next click Ok

- Now, open the Program

- Next open the payroll tax forms

- Follow the prompts to install the Microsoft Visual C ++

- After the installation is done, you will be able to open the Tax Forms.

Solution 3: Reinstallation and Removal of the Sage 50 Accounting Tax Forms

To do so, you will have to:

- Start by closing Sage 50

- Launch File Explorer

- Go to C:\Program Files (x86)\Common Files\Peach (or, on a 32-bit Windows PC, C:\Program Files\Common Files\Peach

- Click Windows + R on the keyboard to Run line

- Enter and type REGEDIT and click on Enter

- Navigate to File

- Go to Export

- Type in the File Name

- Click Save

- Launch HKEY_CLASSES_ROOT, Installer, and then Products.

- Click on Edit

- Click on Find

- Go to ‘Find What’ and type in ‘tax forms’

- Click Find

- At this point the product name on the right-hand side should display Sage 50 Accounting tax forms

- Go to the left pane and delete the 7A4FE1AB76BAB294C9D7A4EE345F3A6C registry key

- Close down the Registry editor

- Now launch the Internet Explorer

- Download and install the same

- Open Sage 50

- Go to Payroll Tax forms

- Run W-2

- Once prompted to install the Microsoft Visual C++ updates and Microsoft Redistributables

- Click on Finish

- Once again launch the Payroll tax forms

- Run W2 again

- This should fix the error now.

Solution 4: To Run PREREQUISITES.EXE

To do so, you will have to:

- Start by closing Sage 50

- Launch File Explorer

- Go to C:\Program Files (x86)\Common Files\Peach\FormViewer (or, on a 32-bit Windows PC, C:\Program Files\Common Files\Peach\FormViewer)

- Next double click PREREQUISITES.EXE in order to Run it.

- Now, follow the prompts to install the Microsoft Visual C ++ updates and redistributables

- After this is done, you can open the Payroll Tax forms and run W-2

Solution 5: Manual Installation of the Missing Updates

This is one of the best solutions to opt for when you do not know how to proceed:

- Go to Microsoft.com

- Download, install and Search the missing Microsoft Visual C ++ updates

- Now restart the system

- This should be able to resolve the error

Related Post: Sage 50 Incorrect Payroll Taxes Calculation Problem

Conclusion

These are some of the most important solutions for the Sage Error: “reading setup initialization file” when opening payroll tax forms. Be sure to follow each of these steps carefully, and you will be surprised by the ease with which the issue is resolved. However, if you still encounter problems, you can easily reach out to us 1800 964 3096 and our team of experts will be more than happy to help out. If you have any specific query, also get in touch with the experts of Sage 50 Live Chat 24×7 Helpdesk.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

💠Frequently Asked Questions💠

What are Payroll Tax Forms?

There are four different Payroll tax forms to choose from:

🔹 Internally managed Payroll Systems

🔹 Professionally managed Payroll systems

🔹 Agency managed payroll services

🔹 Software managed payroll

What are the Tax Forms Needed for Employees?

For the employees, you will need a Form W-4 and an Employee withholding certificate for each employee. Be sure to give a signed W-4 form as soon as they start working.

State the Most Important Types of Payroll Taxes.

The Medicare tax and Social Security tax are the two most important forms of payroll taxes that are deducted from the employer’s wagers. These are charged via flat rates.

Does Sage 50 Include Payroll?

Sage 50 is a scalable, on-premise accounting software that allows automated administrative tasks to be performed with ease. These include payments, and invoicing inventory management among others.

See also: Sage 50 Missing Invoice