Eliminate Paycheck Errors in Sage 50

Updated On: April 3, 2025 6:47 am

Payment and invoicing are one of the most important modules embedded in Sage 50 Accounts. With the help of this, businesses can create and ensure timely payments of invoices related to their products and services, with effortless ease. They can make payments in time, track how much to receive from the customers and vendors, when the payments are due and others.

User Navigation

If you are fairly new to Sage 50, it’s pretty common for you to experience errors while generating paychecks in Sage 50. This is what happened to many users and in this blog, we will look at how to address this issue. By eliminating paycheck errors and maintaining accurate payroll data, you can keep your staff happy.

Here we go..

Procedure to Correct the Paycheck of an Employee

Please follow the steps below :-

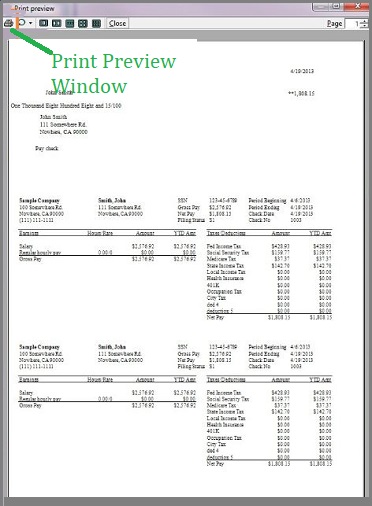

Print Historical Paychecks

Before starting to rectify an error in the payroll, please ensure to have the details regarding the original payments of the employee. For this information, you can reprint the paycheck of this employee. This will help you calculate any adjustments after the necessary correction is made.

Rollback

By using the RollBack option, you can remove the employee’s payment history. Now you can go back and enter the corrected values related to his paycheck.

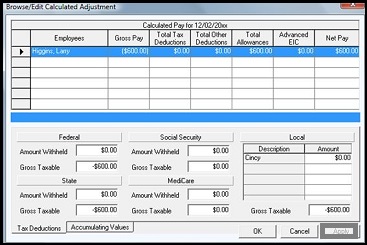

Enter the Corrected Values

- Click on Payroll.

- Click on the Change Process Date tab.

- Now enter the original payment date and click OK.

- Click on Enter Payments.

- Enter the corrected values. The deductions will be recalculated automatically.

- Click Save or Next,

- Click Close.

- Now go to Pre-update Reports and choose the relevant paycheck layout.

- Click Preview to check if the values are correct.

- If satisfied, click Print.

- Click Close twice.

- Click on Update Records and click Yes.

- Once the wizard is complete, click OK to finish.

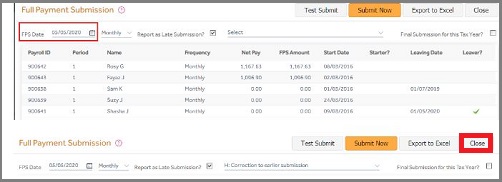

Submit an FPS (Full Payment Submission) or FPS Adjustment

- If you are yet to submit an FPS for this pay period, you will need to submit the FPS as normal.

- If you have already submitted an FPS for this period and have noticed the mistake after submitting the same, you must submit an adjustment against this FPS.

Adjust Net Pay and HMRC Payments

If after the correction, the net pay of the employee has changed, you will need to ensure that the correct amount has been paid to him. To make sure, compare the original paycheck with the new paycheck. You will also need to reprint your P32 report and pay the new corrected amount to the HMRC.

Conclusion!

We hope the above discussion would help you eliminate paycheck errors in Sage 50. If you are still facing any difficulties related to this, you may speak to the Sage experts.

Frequently Asked Questions:

What is meant by a Correction in Sage Payroll?

There may be times when you need to amend your payroll. For example, you may have forgotten to pay overtime to an employee, or you’ve processed an employee using the wrong tax code. If you need to correct any errors or make any adjustments, you can edit a completed pay run in corrections mode.06-Oct-2022

How to Avoid Payroll Errors?

To avoid payroll errors, you need to follow the below tips :-

Stay updated with Payroll Regulations: Keeping yourself well informed about local, state, and federal laws concerning payroll. Here one needs to understand tax obligations, minimum wage requirements, overtime rules, and any changes in labor laws. Also. Regularly review relevant government websites or consult with legal professionals to ensure the right compliance.

Maintain Accurate Employee Records: Maintaining comprehensive and up-to-date records for each employee. This also comprises of personal information, tax forms (W-4 or equivalent), banking details, salary history, and any required employment agreements. Regular audits and verification of these records also avoid a great deal of discrepancies.

Using Reliable Payroll Software: It is a great idea to Invest in a reputable payroll software system that benefits all your business needs.Reliable software can easily automate calculations, and tax deductions, and generate payslips. Check out for software that integrates within your accounting systems and offers compliance features, such as tax updates and reporting.

Automate Processes: Manual data entry increases the risk of errors. Leverage automation whenever possible to streamline the payroll processes. Automate calculations, tax deductions, and direct deposit transfers. This reduces the chances of mistakes and also saves time.

Double-Check Calculations: Even with the help of automation, it is important to review payroll calculations. Regularly audit payrolls to verify accuracy and double-check tax withholdings, deductions, overtime calculations, and any special allowances. Establishing a review process to catch any errors before finalizing payments.

Maintain a Payroll Calendar: It is a great idea to Create a calendar outlining payroll processing dates, tax deadlines, and reporting requirements. This helps make sure you meet all payment and compliance obligations on time. Including reminders for tasks such as submitting tax forms, filing necessary reports, and remitting payroll taxes.

Train Payroll Staff: Proper training of your payroll team to understand payroll processes, compliance requirements, and software usage is a good idea. Make sure to keep them updated regarding any changes in regulations and processes. Offering resources, such as manuals or online training, to assist them in their roles, and to encourage ongoing education to stay updated with payroll best practices.

Regularly Reconcile Payroll Accounts: Reconciling payroll accounts and comparing payroll reports within the financial records on a regular. This helps identify discrepancies and ensures accuracy. Investigate any discrepancies promptly and take corrective actions.

Conduct Periodic Audits: Conducting internal audits in case of your payroll processes and records. Reviewing the employee classifications, timekeeping practices, and payroll reports.This allows us to identify potential errors, compliance issues, or inefficiencies. Rectification of any problems discovered during the audits is a good idea.

Seek Professional Assistance if Needed: Payroll management can be quite complex, and errors can have serious consequences. In case you lack expertise or resources, consider outsourcing payroll to a professional payroll service provider. They can handle payroll processing, tax filings, and compliance for you.

How to Reset my Sage Payroll?

To rest the Sage payroll, you need to :-

1. Start by Selecting the relevant employees.

2. Now click Payroll.

3. Click Reset Payments

4. Now click Next.

5. In case you do not wish to reset payments for one or more of the employees listed, clear their selection.

6. To clear all hours, multipliers, and rates, select Clear All

7. Finally, click Finish.