Sage 50 Online Payslips: An Employer’s Guide

Updated On: February 5, 2025 9:35 am

If you are an employer, you would surely agree that processing payrolls of your employees and ensuring timely and precise payments to them have been quite a challenge of late. Tax tables and other rules get changed too frequently for comfort. This and other factors have made payroll processing an increasingly complex affair, to say the least. But, if you are a Sage 50 user, you should have been able to accomplish your payroll activities with minimum effort. This popular accounting software has offered a comprehensive payroll module to help all kinds of businesses. With its assembly of functions and highly advanced tools, performing the payroll functions has become a smooth affair for employers, to say the least.

User Navigation

- Accounting Professionals & Specialized Experts

- What Can Sage 50 Online Payslips Feature Do?

- What are the Advantages of the Sage 50 Online Payslips Feature?

- How to Set Up Sage 50 Payslips Online For Your Employees? Or Setup Sage Payslips App

- Procedure to Set up Sage 50 Payslips Online

- How to Resend Email Invitations to your Employees?

- How to Make Payslip Corrections?

- What Will Employees View after they are Set up?

- Conclusion!

- Frequently Asked Questions:

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

One such important payroll feature included in Sage 50 is the generation of online payslips. Are you yet to use this feature? Even if the answer is ‘no’, you don’t need to bother a bit! We are here to assist you. Simply go through this blog. Here, we will discuss certain easy ways to generate online payslips in Sage 50. Perform the steps sequentially and generate online payslips effortlessly in Sage 50.

Here we go!

What Can Sage 50 Online Payslips Feature Do?

With the Sage Online Payslips feature, you can grant access to your employees to view and download their payslips and P60s online. They can also access it on the Sage HR mobile app, which can be downloaded from Google Playstore. Please note that only the Sage Business Cloud Payroll user, registered as the business owner, will have access to the online payslips employer options.

What are the Advantages of the Sage 50 Online Payslips Feature?

- Payslips are published automatically when a pay run is completed.

- All the personal information of your employees is securely stored.

- Your employees can have access to their payslips any time they want.

- You do not need to incur any extra cost to avail of this feature.

How to Set Up Sage 50 Payslips Online For Your Employees? Or Setup Sage Payslips App

We recommend using Sage HR on desktop and tablet devices with the following browsers, before setting up Online Payslips for your employees:

- Mozilla Firefox

- Google Chrome

- Microsoft Edge

- Apple Safari

Please make sure to use the latest version of these browsers for the best performance. You can also use Online Payslips on mobile via the Sage HR app.

Procedure to Set up Sage 50 Payslips Online

- Please register yourself as a business owner.

- Log in to your Sage Business Cloud Payroll account.

- The Summary screen will appear.

- In the bottom right-hand corner, search for the new dialog box.

- Select Find Out More.

- You will get an overview of how this feature works.

- To proceed with the setup, click on Bulk Actions >>Set up Online Payslips. Alternatively, you can directly go to Set up Online Payslips.

- Accept the Terms and Conditions of Sage HR to continue.

- Once you are ready to invite your employees, a dialog box will appear on your screen.

- Click on Go to Invite Employees.

- From your employee list, select the employee you want to provide Online Payslips access to.

- Checkmark the boxes on the left-hand side of the table to choose the employees you will invite. Please make sure the employees already have an email Id linked to their personal details. The email invitation will be sent to this Id, which they will need to accept. If they do not have such an email Id, a Missing Information Required pop up will come up on your screen. Here, you will need to enter their National Insurance numbers and email addresses before you are allowed to continue.

- After you have chosen the employees to invite, click on Invite to Online Payslips.

- Click Continue on the pop up dialog box.

- When you complete your pay run next time, payslips will automatically be published for the invited employees.

- To view employees’ payslips and P60s, select View Online Payslips.

- From the table, you can select any employee, if you want to view his previous payslips and P60s. if you want to have a detailed breakdown of each payslip and P60, you click on any line of the table. You can also download these details from this screen, for all the employees or individually.

Also Read: Convert to Sage Business Cloud Accounting

How to Resend Email Invitations to your Employees?

In case any of your employees has lost the invitation email, or the same has expired, you should do the following to resend the invitation email to him-

- Go to the Employees section

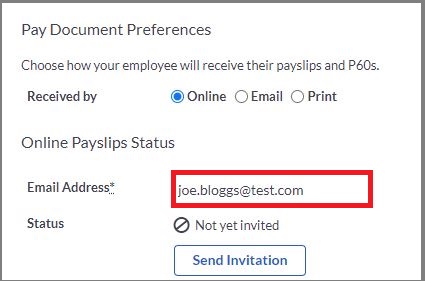

- Click on Pay Document Preferences

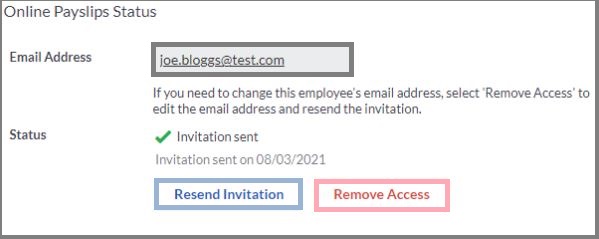

- Select the Resend Invitation button

Please Note: The invitation email will expire 24 hours after sending

How to Make Payslip Corrections?

If you make a correction/adjustment before the online payslips are published, the corrected payslip will be published automatically on the regular publish date.If the regular publish date has passed, before you finish making the corrections, you will need to republish all such corrected payslips. You can do this by going to the Completed Pay Run screen and selecting the Publish Payslips button. Another option is available on the Online Payslips pod on the Summary screen. This will help you upload the corrected payslips and overwrite the existing ones.

What Will Employees View after they are Set up?

On being invited to set up Online Payslips, your employees will receive an email from [email protected]. It will include a link to access their payslips and P60s. After logging in, they will be able to watch a two-minute video that will walk them through the features and how to use them. the employees will also be notified via email whenever a new payslip becomes available.

After logging in, the main screen will show a breakdown of their pay. Another option will be available to view the most recent Payslip in more detail.

Also Read: Sage Employee Login not Working

Conclusion!

We hope the steps mentioned above would help you generate online payslips in Sage 50. We have also discussed other related matters to help employers like you. If you encounter any difficulties while carrying out the procedure above, or if you require additional information about Sage 50’s Payroll Module, we recommend that you contact some experienced Sage professionals.

Frequently Asked Questions:

What is the Procedure to Install the Payroll Tax Updates manually in Sage 50 2022?

Here are the steps to Install the Payroll tax updates manually in Sage 50 2022:

1. Launch the Sage 50 2022 application.

2. Click to open the Reports And Forms section.

3. Click on the Forms tab.

4. Choose Tax Forms.

5. Now click on the Payroll Tax Forms tab.

6. Open your relevant tax form.

7. A prompt will appear, asking your permission to install the tax updates.

8. Next, click on the Download Updates tab.

9. After the downloading process is complete, click Run Update.

10. The installation process of the Sage 50 2022 payroll forms will start now.

11. A prompt will ask if you need to overwrite all the existing files.

12. Click Yes to All to continue.

13. Follow the instructions on your screen to finish the installation process.

What benefits are provided by the Sage 50 Payroll Wizard?

The Sage 50 Payroll Wizard provides the following features and benefits-

1. State & locality defaults.

2. State unemployment limit & percentage.

3. Optional payroll fields for employee tips and meals.

4. General ledger account defaults for your payroll fields.

5. Common state and federal payroll fields for both the company-paid and employee-paid taxes.

6. Payroll fields for employee sick time & vacation time.

7. Payroll fields for employer and employee contributions to retirement plans, insurance plans and flexible spending accounts.

What is Remittance in Payroll?

A remittance is the actual amount you must send to the CRA after providing a taxable benefit or reimbursing a recipient. To learn how to calculate source deductions and your share of EI and CPP, go to Payroll deductions and contributions.