Making Sage Digital Tax for Vat

The process of Making Tax Digital MTD for VAT legislation from HMRC directly affects how all VAT-registered businesses need to do their VAT accounting. So, how do you accomplish MTD for VAT for both agents and businesses? Well, we are here to allow you an in-detail account of the step-wise process of being able to do so. One must also know that Sage’s Making Tax Digital hub gets regularly updated with information. This also involves the timeline of events and a lot more.

User Navigation

- What is Making Tax Digital for Vat all About?

- What Businesses are Exempted from MTD?

- The April 2022 Mandating of MTD For VAT: All about it

- What You Should Know Before You Run a VAT-Registered Business

- When is the Best time for a Business to Start Following the Making Tax Digital for VAT?

- When to File MTD for VAT Returns?

- How to Go About Making Sage Digital Tax for Vat

- What Needs to be Done following the Automatic MTD for VAT Sign Up

- To Activate the MTD for VAT Feature in your Software

- To Create And Submit an MTD for VAT Return

- Accounting Professionals & Specialized Experts

- Frequently Asked Questions

What is Making Tax Digital for Vat all About?

When you are Making Tax Digital for VAT you need to ensure that you submit VAT returns via software in case your business is included in its scope. It is also required to keep your VAT records digital. Here, one must note that MTD for VAT implies using accounting software which can directly connect the VAT Return to HMRC’s systems file. You can also use the computerized accounting process for the same.

The main reason for the users to stay updated about the latest with regards to the MTD is the deadline for the VAT Return filings, and you also need to follow the rules.

As most people might be knowing that since November 1, 2022, one can no longer utilize the existing VAT online account to file monthly or quarterly VAT returns. However, there are a few businesses that have been offered extensions from HMRC.

Read also:

Amended Tax Return form 1040 x

What Businesses are Exempted from MTD?

There are few businesses that are exempted from MTD. But, it is common knowledge that in case the taxable turnover falls below the VAT threshold, it is mandatory that you follow the MTD rules.

However, this does not apply if you gave deregistered from VAT or come under some other criteria:

- In case the businesses are run by certain religious bodies that do not include the use of computers for their everyday use.

- The business of a certain kind that does not include the use of any digital tools for various purposes like record keeping or the need to submit the returns because of disability, remoteness of location or any other reasons.

- The individual or the business is subject to an insolvency procedure

- The individual has been voluntarily registered under VAt and is conducting business under the threshold.

In case you fall under the criteria of being exempted from MTD, but still wish to oblige the MTD rules, you need to inform the HMRC in written form. This needs to be done before the next VAT period starts and you wish to use the MTD services and the date your next VAT period starts.

The April 2022 Mandating of MTD For VAT: All about it

The April 2022 Mandation of MTD has made MAT for the VAT applicable to all registered businesses. This does not apply to those that are digitally excluded.

This was also applicable to those businesses that have been registered for VAT but fall below the VAT threshold; however, this soon changed with April 2022 mandating for MTD for Reconcile vat on Sage.

What You Should Know Before You Run a VAT-Registered Business

It is mandatory for those applying for the MTD registered businesses to follow the rules from the first full VAT accounting period after April 1, 2022. However, one must bear in mind that using the MTD for VAT-compatible accounting software does not directly imply the fact that you are compliant.

Nevertheless, you do not need to register for the scheme as this is done automatically by HMRC. But, it is required that you ensure that the feature is active within your software and you are maintaining the digital accounting records.

When is the Best time for a Business to Start Following the Making Tax Digital for VAT?

To start with, it is fairly for any business new to MTD for VAT to follow the rules. However, one needs to assume that you are below the VAT threshold and fall under the ‘Voluntary filer’ criteria. This means that you will start adhering to Making Tax Digital from the start of the first day of your very first VAT period which has started on or after 1 April 2022.

This implies the following examples:

- In case your VAT period includes a 31 March 2022 end date, the first VAT quarter under the MTD for VAT begins on 1 April 2022.

- In case the VAT period includes a 30 April 2022 end date, the first VAT quarter under the MTD for VAt begins on 1 May 2022

- In case the VAT period includes a 31 May 2022 end date, the first VAT quarter under the MTD for VAT will begin at 1 June 2022

The users also need to bear in mind that since November 1, 2022, you will no longer be able to file monthly or quarterly VAT returns over the existing VAT online account. This is because the route has been currently decommissioned. So, now you are required to use the MTD-compatible software in order to file the VAT returns. It is mandatory to do so, or you might face a penalty from HMRC for not being able to oblige for the same.

This article: Get an IRS Transcript

Note: It is necessary that you need to ensure the submission is in line with MTD the soonest, however, HMRC has offered a short extension for the remaining businesses to register complaints by May 15, 2023.

When to File MTD for VAT Returns?

Before you decide to do so, it is necessary that you bear in mind that the VAT return and payment need to be filed within a calendar month plus seven days after the accounting period for VAT ends. Likewise, it is also smart to ensure that you keep a track of the filing deadline for your businesses in your online VAT account at the HMRC’s official website.

I have Missed my Submissions Date: What to Do?

It is a relief, for many of those who have missed out on the submission date. Making Tax Digital was ‘lenient’ enough to the penalties. However, the platform has grown rather ‘tough’ on this one and one needs to be careful from the start so as to not face the penalties.

So, what can you face, when you miss the date of the submission? To start with, from the start of January 2023 the point-based late submissions system will be applicable for MTD for VAT. The same is also applicable if you are more than 16 days late or altogether fail to agree to the deadline with HMRC.

How to Go About Making Sage Digital Tax for Vat

It has become the top priority for the agents or the accountants to enable the clients to comply with MTD for VAT. So, what are the steps involved? Well, whether you get the job done yourself or hire an agent, you need to know that the following steps are involved in the process of Making sage digital tax for vat.

Total Time: 35 minutes

Get the Right Software

First things first. It is important that you need to ensure that the business you are involved with is compatible with MTD for VAT. This should involve allowing the digital record-keeping and direct VAT returns to HMRC.

Hence, as an agent or an accountant, it is the main priority to ensure that the current software is compatible, or select a third-party software that is compatible with the software. The best part is that the HMRC also includes a choice of tools that allows the search for MTD-ready software which the agents and the businesses can use it. One must know that all Sage products are compatible with HMRC.

To Create an Agent Service Account

The next on the priority list is to create an agent service account. The main importance of this is that it allows you to administer Making Tax Digital on behalf of the client. This also includes both VAT and MTD as and when it is launched in the year 2024, MTD for the income 2022 tax deadline.

However, it is important to note that you need to register with the HMRC as an agent before you register for an Agent Service Account. This is because this is more of a postal application rather than an online one.

So, to be able to apply as an agent, you need to have registered with the Supervisory Authority or the HMRC with regard to anti-money laundering. However, there are chances that this feature is already in place through your Charted body like ACCA, AAT, and CIMA among others.

To Link the Existing VAT Clients to your Agent Services Account

In case you have been previously authorized by your client to file taxes in year 2022 returns instead of them before MTD for VAT, it is mandatory to copy them to your agent service account. The process is rather simple that can be done within the agent service account with the help of appropriate options.

Authorize to Link the New Client

One can use the agent services account to allow them to authorize you in case the client is already signed up for MTD for VAT prior to your involvement with them. Hence, you will receive an authorization request in the form of a web link which is time-limited and needs to be accessed before it expires.

What Needs to be Done following the Automatic MTD for VAT Sign Up

So, how do register for MTD for VAT if you are the only trader, incorporate business or individual?

Well below are the steps involved:

To Check Your Software

Ensure that you are using the MTD-compatible software well selected for the business type you are involved with and will integrate with HMRC. In case the current software does not allows you to submit your VAT returns ‘the regular way’ you might as well opt for other solutions likewise.

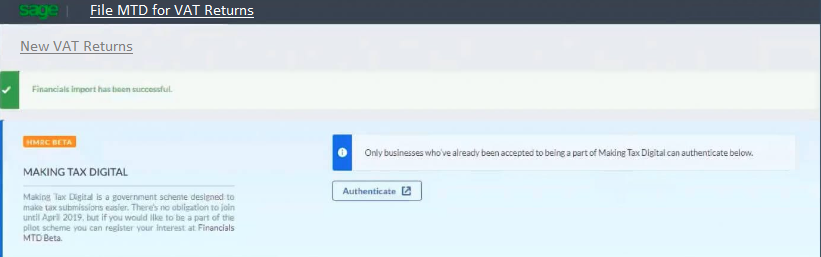

To Activate the MTD for VAT Feature in your Software

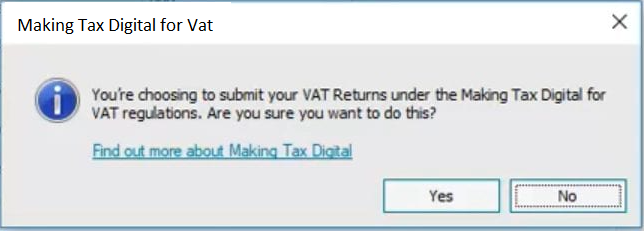

After you have the compatible software in place, it is time to check to the VAT configuration. This is to ensure that the MTD for VAT has been activated. To do so, you need to go to the ‘Enable MTD’, ‘Authenticate’ option that you will find in the Main Menu of the software. Get professional help if you are unable to do so, yourself.

Keeping the Digital Records

It has been recommended time and again to make sure that you maintain the digital records of the current and future VAT returns in your software. This all the more important for the process of MTD for VAT

To Use your Software Round the Year

It is a smart choice to ensure that you use your software through out the year. This includes the features like Quarterly, Annual, or Monthly VAT return directly to HMRC.

To Create And Submit an MTD for VAT Return

It is advised that the user file the VAT through the business’s accounting software as soon as the VAT return date approaches. This can be done through multiple accounting software packages. Here, to do so, you need to locate the option to create a VAT return or report within. In case you have used the accounting software previously it is recommended to keep a record of the VAT accounting fromover the previous time.

This can , however, be generated automatically, but you need to make sure that you enter the adjustments accordingly if need be. Likewise, you need to direct the software to submit while using the MTD process.

Using Sage Accounting to Create and Submit the MTD for VAT Return

To do so, you need to follow the below steps:

- Hit on the Reporting in the Accounts Summery

- Click on VAT Returns

- Hit the blue Create VAT Return option

- At this point the dates are ‘fed’ automatically according to the HMRC’s reporting requirements for your business. To do so, hit on the ‘Calculate’ option provided

- After the dates and the required data has been fed accordingly, you can make your own adjustments.

- To make the adjustments, hit on the ‘Adjust’ option located beside the amount that needs adjustments.

- If you need to view the adjustments, simply click on the ‘Detailed Report’. Likewise, you can also use the Print option to create a hard compy of the Return.

- Once you have reviewed the values of the VAT Return, click on Submit Online to HMRC option.

- Click Save

- Click ‘Finanalise’ once you receive dialogue box that states ‘ are you happy with the returns’.

- Click on Submit

Finally the VAT return list will be displayed where the returns and the brief status message about its progress will be shown. To view the list once again in the future, you can do so by following the process from the Step 2 onwards.

CONCLUSION!

It is essentially easier for people who have signed up for the Making Tax Digital for VAT from April itself. However, the same is not true for the previous users from the year 2019. This is easier because the accountants and the advisors who specials in the subject have two years of experience to be ale to implement the same as required. Likewise, if you encounter any more doubts, feel free to reach out to us, Live chat and call tollfree 1800 964 3096 our team of Sage experts will be more than happy to help out.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

Frequently Asked Questions

What Software are Recommended for Making VAT Digital?

Some of the most well-recommended software are:

🔹 Sage Business Cloud accounting

🔹 Xerox

🔹 QuickFile

🔹 QuickBooks

🔹 Wave

How to Setup VAT on Sage?

To do so you need to:

🔹 Acquire the set up for the MTD

🔹 Delete or Submit any draft VAT returns

🔹 Incase of any failed VAT returns you need to resubmit once again

🔹 Enter the VAT registration number

🔹 Enter the Business setting

🔹 Enter the Accounting dates and VAT

🔹 You are done.