Sage 50 2024 Payroll Update Release Guide

Updated On: January 28, 2025 10:08 am

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

User Navigation

- Accounting Professionals & Specialized Experts

- What’s New in Sage 50 2024 Payroll Update v30.02?

- Download and Install Sage 50 Payroll v30.02

- Before you Install Sage 50 Payroll v30.02

- Download and Install Sage 50 2024 Payroll Update

- Starting the New Tax Year in Sage Payroll (2023/2024)

- Resolution

- Before you Install v29.03

- Download and Install the Sage 50 2024 Payroll Update

- How to Process Your Year End in Sage Payroll?

- How to Process your Year End?

- Get your July 2024 Sage 50 Payroll Solutions Update for Release 2024 now 1

- Is your Tax Update applied?

- Conclusion!

- Frequently Asked Questions:

In the Sage 50 2024 Payroll Update, the Sage 50 payroll users will also have the option to turn on the integration with Sage’s cloud based human resources platform, Sage HR. The Employee Self Service portion of Sage HR is included within the Sage 50 subscription and the other features can also be added.

So, What is Employee Self Service? This is the current integration that allows the employee’s personal information: like name, address and more; and pay slip details to be synchronized between Sage 50 and Sage HR. This implies that the employees will also be able to update their details on their own through the secure online employee portal, or through the mobile app. This helps reduce administrative tasks and information requests for the office staff.

This also takes into account the issue for anyone who pays the employee’s by direct deposit. Till recently Sage 50 did not offer a good method to distribute the pay slips except on paper. But Now the employees can securely access all that information on their own by using the employee portal or the mobile app.

In this feature it is included for all the payroll users in Sage 50 2024 Payroll Update, however turning it on is optional. None of the employee data will be made available online until you go through the steps to set up Employee Self Service.

Also Read: Sage 50 Upgrade to Latest Release 2024

What’s New in Sage 50 2024 Payroll Update v30.02?

Let us take a look at some of the main aspects that are new and latest in Sage 50 Payroll update 2024:

Leave notifications from Sage HR

Once the user has added the Leave Management module to Sage HR Online Services, they can import the approved absences directly into Sage 50 Payroll. Likewise, the user can take action on these as required within your payroll software.

This helps to make sure that the user can record and pay absences correctly the first time. For more information on this, you can visit the import Sage HR absence information to Sage 50 Payroll guide, or watch the related video to find out more.

Historical payslips notifications for Sage HR

The best part about the Sage 50 payroll update 2024 is that, the user can also now set if the employees receive a new payslip notification email once you upload the historical payslips to Sage HR.

Mid-year legislation

Sage 50 2024 payroll update has also added enhancements to speed up processing multiple companies once the new legislation comes into effect mid-tax year.

Download and Install Sage 50 Payroll v30.02

Also, the Sage 50 Payroll v30.02 is now available. To know more, you need to follow the steps below to update the software and find out what is new in this version.

Before you Install Sage 50 Payroll v30.02

To make installing the update easier, it is recommended that the user should run through some checks beforehand:

- Start by preparing to update the software.

- Changes have been implemented by HMRC for their online service on 7 May 2024. This implies that in case you are using Windows 7, Windows 8, Server 2008, Server 2012, or 2012 R2, the user cannot make RTI submissions to HMRC.

Check your version number

To check the version number you need to:

- Click on Help

- Click on About.

- Check your version number within the Program Details

- In case your version number Is 02.076

- the software is already up to date.

- Is 01.283 or below, follow the steps below to install v30.02

Admin rights check

During the process of installation, the software checks to know if the user has admin rights. This helps to make sure that the installer can create and update all files and folders that are required by the software to run.

Download and install the update

If the user wishes to, they can download their update by following the steps below

- Shut Sage 50 Payroll and any other Sage software that you might have opened on your computer.

- Next, click the link to download your update:

- Once a prompt asks the user to select where to save the file, select your Downloads folder, then click Save

- To start the process of installation, go to your Downloads folder and right-click

- exe

- Click Run as administrator.

NOTE: Once asked by the prompt, you need to enter a username and password, enter your Windows administrator credentials and not your payroll credentials.

- To confirm you accept the license conditions, click Accept License then click Next.

- Check if the path is the same as the program directory you noted before you installed the v30.02

- When it is, click Yes.

- When the path is not the same, click No then Yes, and go to the correct program directory

- click exe

- click Open

- Click OK when the installation completes

- Now click Close.

- Save any work that you might opened within other applications, then restart your computer.

- To help keep your software up to date, it is recommended to enable background updates.

NOTE: When you have Sage 50 Payroll installed on more than one system, repeat the steps above on each one.

Once the user logs in to a company for the first time after you install v30.02, the software upgrades the company data to the new version.

After the data upgrade process, the software automatically optimizes the database for the company. This helps to minimize the size of your backups and maintain error-free data.

Also Read: How to Setup New Company in Sage 50?

Download and Install Sage 50 2024 Payroll Update

The user will receive this update automatically through the product. The version for this tax update is 20240101 for the releases 2023 and Sage 50 Payroll Update 2024. Below are the steps to make sure that your tax update has been applied:

- Launch the Sage 50 company.

- Next Select Help > About Sage 50 Accounting.

- Now Confirm that the installed Tax Update version number matches with the version number 20240101.

- In case the Installed Tax Update version number does not match:

- Start by Selecting Services> Check for Updates > Check Now.

- In case the multiple updates appear, select the update that you wish to install, then select Download.

- Once the download is completed , you can exit Sage 50 and the update will start once again.

Starting the New Tax Year in Sage Payroll (2023/2024)

The Sage 50 Payroll v29.03.485 is now available, and it includes the National Insurance changes from the Autumn Statement 2023.

In order to stay compliant, it is recommended that you install this update as soon as possible. v29.03 also comprises the correct legislation for payrolls before 6 January 2024, hence you can update immediately.

Resolution

Let us take a look at the solutions for this problem:

Check your Version Number

- Start by Clicking Help

- Next click About.

- Now Check your version number within the Program Details heading.

- If your version number:

- Is V29.03.485 then your software is already up to date and you do not require to take any further action

- Begins v29.01 or v29.02, follow the below steps below to install v29.03

Compatibility

- Though Microsoft has stopped offering updates and support for Windows Server 2012 and Server 2012 R2, v29.03 is compatible with these operating systems.

- In case you are an Accountant/Bureau who uses Bureau Manager, you are required to download and install Sage 50 Payroll Bureau Manager v4.1 if you install v29.03 of Payroll.

- v29.03 of Sage 50 Payroll is compatible with Excel Integrated Reporting (EIR)

Before you Install v29.03

In order to make the installation process easier, it is recommended that you carry out the required steps below:

- Start by Checking your antivirus software inorder to avoid conflicts with Sage 50 Payroll

- Now optimize your data

- Make a note of the Program Directory

- Start by clicking Help

- Next click About.

- Make a note of the Program Directory

- Now Backup your data

- Next Check if your system meets all the requirements for Sage 50 Payroll.

Admin Rights Check

During the process of installation , the software checks if you have admin rights. This helps to make sure that the installer can create and update all files and folders that your software is required to run. Windows administrator check during installation.

Also Read: How to Restore Sage 50 Backup?

Download and Install the Sage 50 2024 Payroll Update

In case you prefer, you can download the update below and watch a video of the installation process:

- Start by shutting down Sage 50 Payroll, and any other Sage software that you might have open on your system.

- Click the link below to download your update:

- Download Sage 50 Payroll

- This normally downloads automatically to your Downloads folder. If you’re prompted to select where to save the file, select your Downloads folder, then click Save

- Download Sage 50 Payroll

- To start the installation process, locate and right-click Sage50Payroll_2903485.exe

- Click Run as administrator.

Note: In case you are prompted to enter a username and password enter your Windows administrator credentials and not your payroll credentials. - In order to confirm you accept the license conditions, click Accept License then click Next.

- Check if the path is the same as the program directory you have noted earlier, then click Yes.

- In case the path is not the same, click No then Yes and go to the program directory you noted in the before you install v29.03 section, click Payroll.exe

- Next click Open

- Click OK, once the installation completes,

- Next click Close.

- In order to help keep your software up to date, it is recommended you enable background updates.

TIP: In case the Sage 50 Payroll has been installed on more than one system, repeat these steps on each one.

Once you log in to a company for the first time after you have installed v29.03, your software upgrades your company data into the new version.

Once the data upgrade process has been done, your software automatically optimizes the database for your company. This ensures to reduce the size of your backups and maintain error free data.

Also Read: Fix Sage 50 Upgrade Error

How to Process Your Year End in Sage Payroll?

Now let us take a look at what is new in Sage Payroll for the year 2023/2024:

- The emergency tax code remains at 1257L.

- There is no uplift to the Personal Allowance.

- The user might receive P9 notices from HMRC.

- In order to view tax code notices you need to log on to HMRC’s PAYE online service or even use their PAYE Desktop viewer.

- The Tax code changes are effective from 6th April 2023 and should be applied once the 2022/2023 processing has been completed.

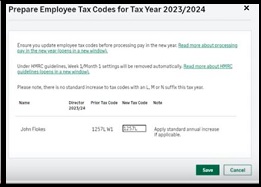

Once you run the Payroll for the first tax year you will receive the following message:

The user can fix the Tax hold here if needed.

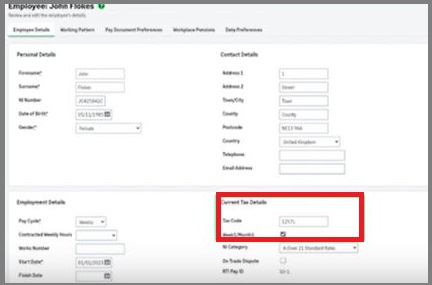

- Likewise, you can do the same within the Employee record as shown below:

- There are no further changes to the National Insurance bands or rates for the employee in the current year.

- Starting from 12th April 2023, the statutory sick pay rate is 109.4 Pounds per week.

- However the Statutory parental pay has increased to 172.48 Pounds per week.

- Likewise the Student loan thresholds have also increased from April 2023:

- Plan 1: 22.015 Pounds

- Plan 2: 27.295 Pounds

- Plan 3: 27.660 Pounds

- Post graduate loan: 21000 Pounds.

How to Process your Year End?

- Go to the Main Menu

- Now Select ‘Year End’.

- Next check the Tax year to report on

- Step 1: Review Employee Pay value. This is to check the values and to make the required corrections if required before the completion of the pay year end payroll.

- Select on the Review Employee Pay to get the list of the employees you have paid for this tax year.

- You can click on View P 11 to acquire more details about each employee and their payment details.

- To view P 11 for all the employees at a single go, you can click on ‘View P11 for all employees’.

- These reports can be printed or exported as required.

- Once checked go back to ‘Return to Year End’.

- Click the check box to confirm that step 1 is complete.

- Go to Step 2: Which is the Employer Payment Summary submission or EPS.

- Click on the Checkbox ‘Submit EPS’.

- This is the final EPS of the Tax year, and the submission should be sent to the HMRC by the end of 19th April.

- The countdown to the date is also displayed here.

- In order to initiate the final EPS Click on Submit EPS.

- In case you need to close the PAYE scheme Click select on the check box: ‘The company has closed down the PAYE scheme’.

- Enter the Cessation date here.

- In case you are not closing the PAYE scheme do not select the check box.

- Next, check the CIS deductions suffered, along with recovery and compensation values.

- Now click Next to go to the next step.

- In order to change the Saved HMRC user credentials click on CHANGE.

- In case there has been no change to the details, since the last full payment submission, click on ‘Submit’.

- Once done, you will be notified as ‘EPS is Being Transmitted’.

- Next step is to Go to the Distributed P60 Certificates To Employees’.

- This needs to be completed by the 31st of MAY and the countdown for the same is also displayed at the table.

- The P60 certificate will be produced for all the employees who are still employed by you by the 5th of April.

- You can also print the P60 certificate by clicking on the option.

- Likewise, you can also view the P60 for individual employees by clicking the link next to their names.

- Alternatively you can also view all of them at once by clicking on ‘View All’.

- This can be either Printed or saved on your system.

- Now click on Return to the Year End.

- Next mark the step as complete select the check box: P60 distributed to Employees.

- Now you need to proceed to the Submitting the Supplementary FPS

- This is not a mandatory step, but is recommended nevertheless.

- It is required in case the user has made any corrections to the 2022-2023 tax year Processing after you have processed and submitted the final pay run of the tax year.

- In order to do this, you need to click on Submit supplementary FPS.

- Now simply follow the on-screen instruction to complete the entire process.

- Click on Confirm.

- Click on Submit.

- The corrected values will be automatically sent to the HMRC.

- In case you have not corrected the payroll since the last pay run 2022-2023, this step is not required.

- And you are done.

Also Read: Download Sage 50 2024

Get your July 2024 Sage 50 Payroll Solutions Update for Release 2024 now 1

Correction for 2-factor authentication (2FA) and Direct Deposit sync error:

- This update consists of a solution for a problem that might prevent the Direct Deposit sync when 2FA is used with SMS text: Error: “Authentication problem. We are unable to authenticate your credentials at this time.”

Note: To apply this solution, you have to be on Release 2024.0.1 before trying to install the July 2024 tax update. In case you are utilizing Release 2024.0, it is recommended to install the 2024.0.1 update before installing the July 2024 tax update. Click Download Sage 50—U.S. Edition 2024.0.1 Update.

Is your Tax Update applied?

The user will receive this update automatically through their product. The version for this tax update is 20240701 for the release of 2024. Here are the steps to ensure that your tax update has been applied:

- Launch the Sage 50 company.

- Now click Select Help

- Next, click on About Sage 50 Accounting.

- Now confirm if the installed Tax Update version number matches version number 20240701.

- In case your Installed Tax Update version number does not match:

- Click on Services

- Now to Check for Updates, click onCheck Now.

- In case of multiple updates, select those update(s) you wish to install

- Now select Download.

- Once the download has been completed, exit Sage 50, and then the update will start again.

Also Read: Sage 50 Accounting 2024 Release Notes & System Requirements

Conclusion!

So, there you have it people, these are some of the main aspects about the Sage 50 Payroll Update 2024. However, if you still have doubts regarding the same do visit us at accountingadvice.co and you will discover the latest details about the same.

Frequently Asked Questions:

How can one Install the Sage Payroll 2023?

In order to do so, you need to:

1. Shut down Sage Payroll 2023.

2. Next download Sage Payroll update.

3. Now Locate and right-click on the SagePayroll_V26.3.exe file

4. Next click Run as administrator.

5. Click Select the I accept the terms of the license check box

6. Now click Next.

7. Click select on this Computer, then click Next.

8. Click select Custom, now click Next.

9. Check if the program directory and data directory are the same as you had noted earlier.

10. In case not, click Browse, now enter the correct directories, then click OK.

11. Click Next, then select the Add shortcuts to my desktop check box.

12. Click Install

13. Finally click Finish

Can one Update the Sage to the Latest Version?

Yes it can be done, from within your Sage 50 Accounts software:

1. Go to the menu bar

2. Now click on Help

3. Next click Check for updates.

4. Finally Follow the on-screen prompts

Is Sage 50 Payroll Cloud-based?

Yes it is.