Access 1099-NEC Form Files for Use with Sage 50 Checks & Forms

Updated On: May 22, 2025 6:07 am

It is important for businesses to stay on top of their taxes. This includes filing 1099-NEC forms, which are used to report payments made to contractors and others who provide services during the year. While many companies have access to software that can help with filing these forms, there may be times when the data must be exported into a file that is compatible with Sage Checks & Forms. In this blog post, we will discuss how to Access 1099-NEC Form Files for Use with Sage 50 Checks & Forms.

User Navigation

- Accounting Professionals & Specialized Experts

- Why is it important to Print the New 1099-NEC in Sage 50?

- What are 1099-NEC Form Files?

- Solution to access 1099-NEC Form Files for use with Sage Checks & Forms:

- Methods to Printing the New 1099-NEC in Sage 50

- Final Words

- Frequently Asked Questions:

- How do I Fill out and Read Form 1099-NEC?

- Does Form 1099-NEC be Electronically Filed?

- How do I Print the 1099-NEC on the Blank Perforated Forms using Aatrix?

- What Form can a User Use to File 1099-NEC?

- How Can the user Print or e-file the State Quarterly Forms in Sage 50?

- Is it possible to print my own 1099-NEC forms PDF?

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

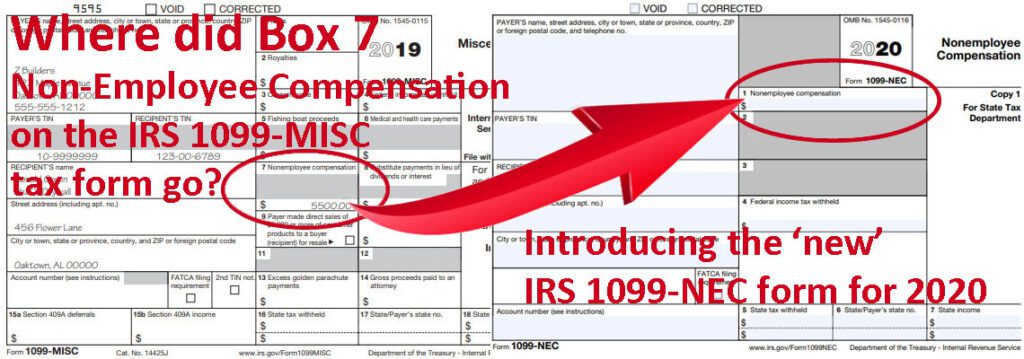

You may have probably heard that instead of the 1099-MISC, non-employee compensation must now be recorded on 1099-NEC form file. However, other forms of payments like rents, dividends, attorney fees, etc continue to be reported on the 1099-MISC, but non-employee compensation (payments to contractors) now has its own form, the 1099-NEC.

The most of the Sage users’ concerns is “How do I access 1099-NEC form files for use with Sage Checks & Forms”. Don’t worry! The below write-up explains the entire process so that you can make easy access of 1099-NEC forms files. Before you jump to the procedure, let’s know what exactly 1099-NEC form files in detail.

Why is it important to Print the New 1099-NEC in Sage 50?

Most Sage users might be aware of the fact that the Compensation made to a non-employee is reported using the 1099-NEC form. The reporting of payments made to non-employees will no longer be included within Form 1099-MISC as of 2020. This is according to the IRS, which also has revamped the form. The 1099-NEC has undergone further revisions for 2021.

What are 1099-NEC Form Files?

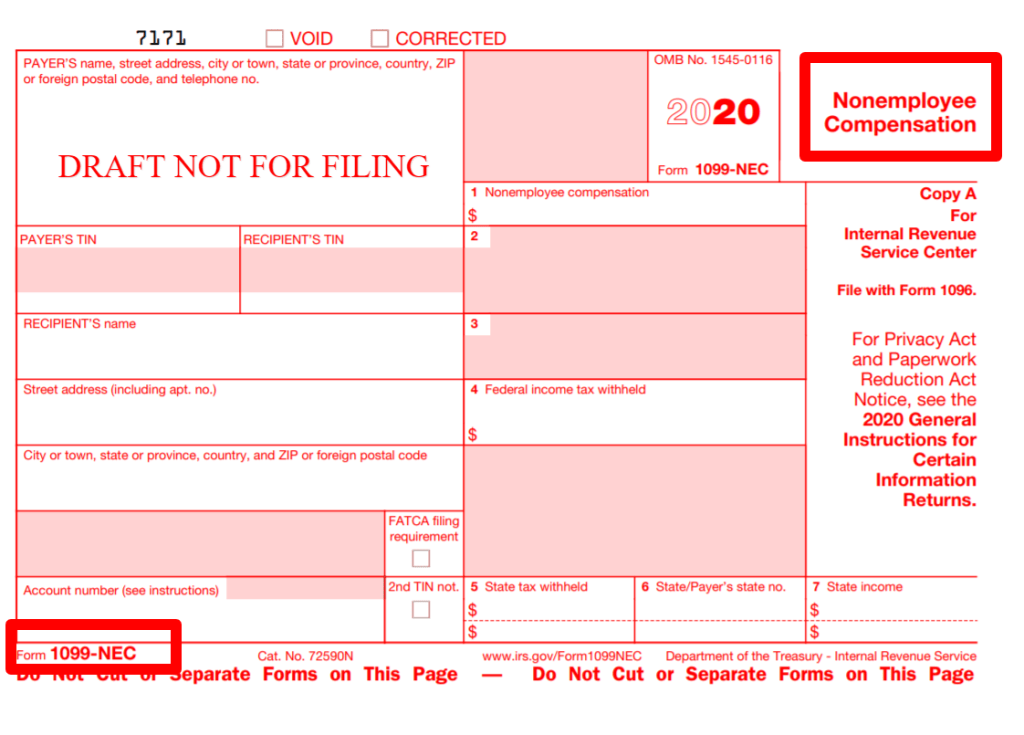

For tax year 2020, the IRS has separated the registration of compensation to non-employees from Form 1099-MISC and redesigned it. The current Form 1099-NEC which is actually an old form that hasn’t been in use since 1982, it is used to record any compensation paid to nonemployees by a company.

If all four of the following requirements are met, all companies must file a Form 1099-NEC for nonemployee compensation:

- It is addressed to an individual who is not one of your employees.

- It’s designed to be used for services provided in the course of your trade or business.

- It was sent to a single person, a partnership, an estate, or a company.

- The payee received at least $600 in payments over the course of the year.

Solution to access 1099-NEC Form Files for use with Sage Checks & Forms:

Follow the below instructions to access 1099-NEC form files for use with Sage Checks & Forms:

- First, save the .FRM files to your computer system desktop.

- Next, locate the Sage 50 data path.

- Now, locate the folder called Forms inside the Sage 50 data path.

- After that, copy the downloaded .FRM files from your desktop.

- Then paste them in the Forms folder.

- Once done with that then open Sage 50 and your company, the forms display in the Tax Forms section of your Sage 50 Forms.

- The names of the forms are as below:

- Form 1096 2020 Preprinted.

- Form 1099-MISC 2020 Preprinted.

- Form 1099-NEC 2020 Preprinted.

Form Alignment

Because each printer is different, it is recommended that an alignment page be printed before printing to ensure that the data can fit correctly on the type. Print an alignment page in Sage 50 by following the instructions below:

- Open the company files of Sage 50 (if you are unable to open company file).

- Select the Reports & Forms >>> Forms >>> Tax Forms.

- Select the form which you wish to align (for example 1096 IRS 2020) in the Select a Report or Form window section.

- Now, go to the Form designer window and click Print from the top toolbar and then select Print.

- Make sure that you have pre printed 1099 form loaded into your printer.

- After printing the placeholder info, you’ll be asked whether the form aligned properly or not and you’ll be asked to answer Yes or No.

- If you choose “No” that you’ll be presented with alignment options to move the form contact up, down, left or right and then print another sample.

- If you select “Yes” then the form alignment will remain as it is.

Methods to Printing the New 1099-NEC in Sage 50

Here are the two different methods related to printing the new 1099-NEC in Sage 50:

Method 1: In Case of the Payroll Subscribers- 4-Part Blank Perforated form or eFile

Note: The 1099 and 1096 forms will not be accessible for printing from the Forms menu within Sage 50 as of the 2023.0 release. Nevertheless everyone who has an active plan will be able to make use of Aatrix inorder to print 1099/1096 paperwork. An Aatrix eFile subscription or manual filing with the IRS are necessary for efiling. Also the Customers using Sage 50 Documents can still print 1099/1096 forms in case they are using release 2022 or earlier.

On December 16, 2020, the 1099-NEC Form has been made available to all the clients with payroll subscriptions through an Aatrix forms update.For this you need to go to the Reports & Forms >>> click on Forms >>>Next click on Tax Forms, after that double-click Payroll Tax Forms in order to view the most current tax forms. This will load the most latest forms for you and automatically be able to install any Aatrix tax forms that are lacking.

The user needs to be utilizing at least the 2021.1.1 or ideally 2022.1 release and have the most latest tax update loaded in order for the data to instantly appear on the 1099-NEC form.

Steps to Print e-file the 1099-NEC/1096 Forms using Aatrix Forms:

- Start by navigating to the Reports & Forms >>> Next click on Forms >>> Now click on Tax Forms and double-click Payroll Tax Forms located at the bottom in order to print or electronically file the 1099-NEC/1096 forms using Aatrix Forms

- Next, go to the list of Available Forms, and select the required 1099 form (1096 forms are also generated as section of the 1099 filing)

- Now select the appropriate filing year

- Once done, you need to click on the Ok option.

- Finally Complete the form by following the instructions and entering any required data.

Method 2: For all Customers – Print to 3-Part Red Copy or IRS Scannable Forms

Important Note: The 1099 and 1096 forms will not be accessible for printing from the Forms menu within the Sage 50 after the release of 2023.0. Nevertheless, through Aatrix, any clients with an active plan will be able to produce 1099/1096 forms. The IRS should receive a manual filing or an electronic filing through Aatrix. Also the Customers running releases 2022 and earlier can still print 1099/1096 forms by using the Sage 50 Forms menu.

One can print the 1099 and 1096 forms through Sage instead of Aatrix in case they do not own a payroll tax subscription.

In order to Print the 1099 and 1096 Forms using the Sage 50

- Start by Selecting Forms, Tax Forms and Reports & Forms

- Now click select the 1099-NEC or 1096 form that you need.

- Next select the reporting year

- Vendors can be filtered using ID, active/inactive status, or payment method

- In order to obtain a preview of the printers, click on the “Refresh List” option

- The 1099 forms can be printed by selecting Print/E-mail or by selecting Print Preview inorder to see a screen preview of them.

Also Read: How to Print 1096/1099 Forms in Sage 50?

Final Words

So, this is all about the 1099-NEC form files and how to access 1099-NEC form files for use with Sage Checks & Forms. With this accessibility, you can file a 1099-NEC form to record any compensation paid to nonemployees by a company. Furthermore, even if the total is less than $600, you must file Form 1099-NEC for those from whom you withheld federal income tax under backup withholding rules for any amount. If you still have have doubt or want to know more about the 1099-NEC form, then you must connect with our Sage support team through Sage live chat .

Frequently Asked Questions:

How do I Fill out and Read Form 1099-NEC?

There are mainly 5 essential parts to form 1099-NEC and they are:

1. The information of payer.

2. The information of recipient.

3. Nonemployee compensation amount.

4. Federal income tax withheld.

5. State information.

6. Additionally, name, address, and taxpayer ID are all included in the details provided by both the payer and the receiver.

7. Box 1 contains non employee benefits, which may provide the average compensation for the previous tax year.

8. Box 4 is where you declare any federal income tax withheld, but this is rare unless you’ve received a backup withholding order for that individual. If your state has an income tax, fill in box 5 with the total amount paid to that individual for the year, as well as any state taxes you withheld.

Does Form 1099-NEC be Electronically Filed?

Yes, Form 1099-NEC can possibly be filed electronically with the IRS.

How do I Print the 1099-NEC on the Blank Perforated Forms using Aatrix?

Printing the 1099-NEC is very simple, you are just required to follow the below instructions:

1. First, go to the Reports & Forms >>> Forms >>> Forms >>> Tax Forms.

2. In the list of forms, do a double-click on the Payroll Tax Forms.

3. Once the Payroll Tax Form Selector window opens.

4. Then the next step is to choose the 2020 1099-NEC from the list of federal forms.

5. Select the 2020 for the year then click Ok and then perform the prompts in the wizard.

What Form can a User Use to File 1099-NEC?

The user will use the amount in Box 1 on your Form 1099-NEC in order to report the self-employment income. So, Instead of putting this detail directly on Form 1040, you will be able to report it within Schedule C.

How Can the user Print or e-file the State Quarterly Forms in Sage 50?

Here are the steps to print or e-file the state quarterly forms in Sage 50:

1. Start by selecting the Forms from within the Reports and Forms menu.

2. Next, the Tax Forms can be accessed by clicking on it.

3. Now the Select a Report or Form window will be displayed.

4. You need to on the Double-click Payroll Tax Forms next.

5. Next click Select the State form type by tapping on it.

6. Next select your state.

7. Now Indicate the state that you wish to print or e-file for.

8. You need to select the filing period area by clicking on it.

9. Finally give the year and quarter.

Note: Please bear in mind that you are required to select your preferred year and quarter once again if you click on a different form.

10. In order to continue, click on the Ok button.

11. Now observe the instructions as they are displayed on the screen.

Is it possible to print my own 1099-NEC forms PDF?

Be sure to not use printed pdf copies for IRS filing. Nevertheless you can still use printed PDF copies in order to notify the recipients and for your own records (Copy B and C). The deadline for paper filing is January 31st. The mailing address for the 2023 tax year for Form 1099-NEC will be according to the home state of the filer.