How to Change the Financial Year Start Date in Sage?

Changing the financial year start date in Sage is a straightforward process, but it is important to understand the implications of doing so. It is recommended that you consult with your accountant or financial advisor before making any changes to your financial year start date. In this blog post, we will show you how to change the financial year start date in Sage. We’ll also explore some of the benefits and drawbacks of doing so, so that you can make an informed decision.

User Navigation

- Prerequisite Must be followed Before Making any Modifications

- Steps to Change the Financial Year Start Date

- Which Balances are Recalculated?

- Change Your Company’s Fiscal Year-End Date

- How to Change Financial Year

- To Lock the previous Financial Year

- How to Advance the Fiscal or Calendar Year

- Situation 1: Fiscal year is also the calendar year (1 Jan to 31 Dec).

- Understanding the Data Integrity: This warns of the possible Errors in your System

- In Case the option to Start a New Year is not Available, then you need to:

- Situation 2: When the Fiscal Year is different from the Calendar Year (Fiscal start is not January 1)

- Solution: 1 Use to Start the New Calender Year

- Solution: 2 Change the Session Date

- Come to End!

- Accounting Professionals & Specialized Experts

- Frequently Asked Questions(FAQs)

- How do I check that My Financial Year start date is correct in Sage?

- What are the things you Need to Check before Year End in Sage?

- What are things that I should check after I finish the Financial Year end Process in Sage?

- How can the User Change the Financial Year in Sage 200?

- How to Change the Accounting Year?

- How can One Change the Date on Sage?

- How can One Extend the Next Financial Year in case of Tally?

- Can the User Extend the Accounting Period?

- Can a User Change the Financial Year?

Formerly known as Simply Accounting, Sage 50 is a software system for accounting and company administration. It allows you to conduct a wide range of software activities, including adjusting the fiscal year’s start date. During your first fiscal year, you have the option to adjust the start date. After that, you must modify the fiscal year end date, which will set the new fiscal year start date to the next day. However, there can be many reasons when the fiscal start date was entered is wrong or if your financial year changes and you need it to start at a different time, you must change the financial year start date in Sage Accounts. In this blog post, you’ll learn how to change the Financial Year Start Date in Sage and other useful information related to it.

Prerequisite Must be followed Before Making any Modifications

Make a backup copy of your data (using a different company name) and then attempt changing the date. You’re sailing if it works. If the first attempt fails, restore the backup and try again. When you’ve gotten what you want, go back to your good data set and repeat the process. Before you perform anything like this in a test environment or in production mode, be sure you have a backup of your data. After you’ve backed up your data, you might want to do so again. It’s always useful to have a set of test questions on hand. Keeping them straight is all that matters.

Steps to Change the Financial Year Start Date

You must set the financial year start date to the prior year when changing the financial year start date. Set the financial year to January 2020 if you want the new financial year to begin in January 2021.

- Initially, click on the Settings >>> Financial Year and then click on the “Change” tab

- Next, hit the “Yes” button to the prompt regarding backups and check data

- Again, click “Yes” to the prompt regarding nominal historical data

- After that, set the required financial year start month and year as you can see the above discussed example

- Finally, click “Ok” >>> “Yes” >>> again “Ok” and then one more click “Ok”.

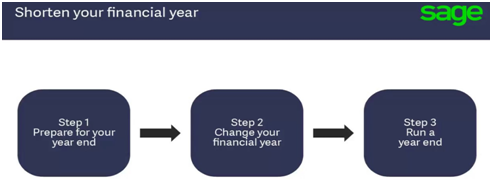

Now, let’s Know How to Shorten the Financial Year

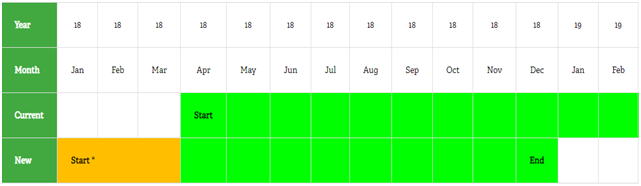

When you first install Sage Accounts, you’ll be asked to enter the month and year in which your financial year begins. This financial year option is required, and once selected, your financial year will continue for 12 months from the day you enter as the start date.

Because Sage Accounts can only have a 12-month financial year, if your financial year has changed and you need to shorten it, you must push the start date back to match the new end date.

Which Balances are Recalculated?

The following changes occur when you utilize the Financial Year option to change your financial year’s start date:

- The monthly nominal code balances are recalculated using the audit trail transactions.

- Based on the transactions on your audit trail, your year-to-date turnover figures for your customers and suppliers are computed.

- The product records’ monthly sales amounts are revised depending on product transactions.

Related article : How to Change Fiscal year without adding Historical Transactions in Sage?

Run the Year End Reports to End of Shortened Period:

Run the reports for the end of the shortened financial year. Some common reports include:

- Profit & Loss

- Aged debaters

- Run Trial balance Report

- Aged creditors

- Balance sheet

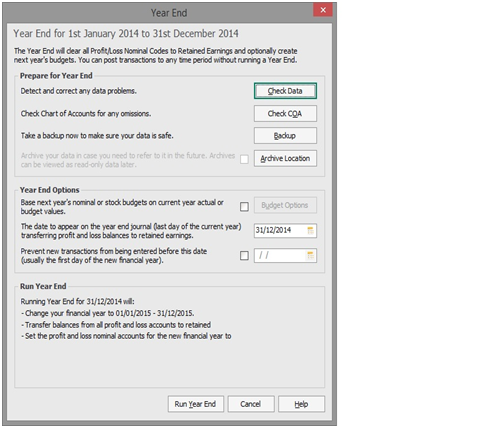

Run the Year End:

The profit and loss data are cleared up to and including the year end date.

The Financial Year Start Date is Advanced to the Needed Start Date

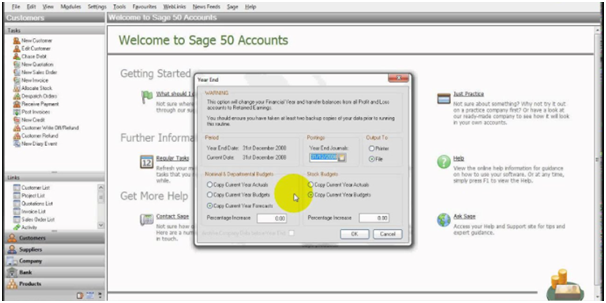

- Click on the Tools >>> Period End and then click on the “Year End”

- Next, click on the “Check Data”, if you have any data errors then you can fix them here and then click “Close”

- Now, click on the “Check COA” option and then hit “Ok”

- After that, click “Backup” and then click “Ok” and again click “Ok”

- Leave the Archive checkbox selected, if you want to create an archive of your data

- Select the Budgets checkbox to set up budgets for new Financial Year and then choose the budget option

- Check the date is the year that you are closing

- Enter a lock date if needed

- Next, click “Run Year End” >>> “Yes” and then click “Ok”

- At last, select how you want to output the report and then click the “Ok” button twice.

Change Your Company’s Fiscal Year-End Date

In order to change the Company’s Fiscal Year End date, one needs to follow the below steps:

- Go to the Setup menu

- Go to Home windows

- Now select Settings.

- Go to the left side of the window,

- Now click Company,

- Click on Information.

- Type in the date of the last day of your fiscal year in the Fiscal End box.

- Finally, Click OK.

- And you are done.

How to Change Financial Year

Once when you have entered the financial year-end date incorrectly, or in case the date has been entered wrongly, you can make changes to your year-end date at any time. However, the financial year can only be 12 months.

The steps to be followed when doing so are as below:

- Go to the Settings

- Go to the Business Settings

- Select Accounting Dates & VAT

- Next, enter the last date of the new financial year within the ‘Year and Date’.

- Click on Save located at the bottom of the page.

Once when the changes to the dates of the financial year are done, the financial reports are automatically reflected in the new financial year. So, you just need to change the Year End Date and the start date is set automatically. After you have applied the above steps, the financial year has now changed. Now, all the reports for the current and the previous years will apply to the new financial year.

For instance, if the user has changed the financial year-end date from 31 December 2022 to 31 March 2023, then:

- This financial year is from 01 April 2022 to 31 March 2023

- The last financial year is from 01 April 2021 to 31 March 2022

To Lock the previous Financial Year

You will need to enter the lockdown date in case you wish to prevent the transactions from being accidentally entered for the previous year. For instance:

If the financial year ends on December 31, then you need to enter 31 December as the Year End Lockdown date. Now, the next new transactions can only be entered from 1 January onwards. In case you have the transactions that need to be entered for the previous year, you simply have to remove the Year End Lockdown date.

How to Advance the Fiscal or Calendar Year

It is advised by the experts to make sure that the backup of the data has been created before the application of the solutions. If required you can also seek professional help from a qualified person to do so :

Situation 1: Fiscal year is also the calendar year (1 Jan to 31 Dec).

- Go to t Setup > Settings… > Company > Information in order to check the Current Year Dates

- In case the current fiscal year coincides with the calendar year (January 1 to December 31), this will cause the program to automatically start the fiscal and calendar year on the same date

- Click OK to close the Settings window.

- Click Maintenance > Check Data Integrity.

- Ensure the Integrity Summary window mentions Data OK at the bottom.

- In case the data integrity is not OK, Then you need to follow the below steps:

Understanding the Data Integrity: This warns of the possible Errors in your System

- Click on Maintenance, and Check Data Integrity to make sure your accounts and sub-ledgers balance.

- The left side (L) of the Integrity Summary window is the General Ledger balance as of the latest transaction date

- The right side (R) of the Integrity Summary window is the balances associated with your customers, vendors, or employee

- The A/P balance (L) should always match the Unpaid Invoices (R) like the example below

- Click Select Setup, Settings, Company, then Currencies to check if you are using foreign currencies.

- In case there is more than the home currency, then you are using foreign currencies.

In Case the option to Start a New Year is not Available, then you need to:

CASE 1: If one or more Windows are Open

- Click Select View, then Close all other Sage 50 windows.

- Verify that the option is no longer greyed out

CASE 2: If in History Mode

- Create a backup

- Next Exit history mode

- Finally, Verify that the option is no longer greyed out

CASE 3: If in Multi-User Mode (Premium or up)

- Go to the Home window, click select File, then Switch to Single-user Mode

- Verify that the option is no longer greyed out

CASE 4: Not logged in as the Sysadmin User

- Go to Sage 50 – New Fiscal and Calendar Year window, Click on Yes to make a backup.

- Once the backup has been completed, click on OK on the Sage 50 – Information window that tells you the years were created successfully.

- Click on No when asked if you want to clear the old data.

- Close the Checklist window.

- Next, Close the Daily Business Manager window.

- Now the new fiscal or calendar year has been started

- Repeat steps 3 and 4 in order to verify the data integrity again.

Situation 2: When the Fiscal Year is different from the Calendar Year (Fiscal start is not January 1)

Solution: 1 Use to Start the New Calender Year

Option 1: Rolling your payroll year forward (use to start the new Calendar year only)

- When you roll into a new calendar year, this will cause all YTD payroll will be reset to zero.

- As this is done, the program will not automatically calculate the payroll taxes for the prior calendar year.

- Create a backup of your data.

- If you are using Sage Pro, Premium or Quantum: Ensure that the user is logged in as a single user with administrative rights.

- Click on Maintenance > then Start New Year.

- Click on the Calendar year.

- Click on OK.

Option 2: Steps for rolling your fiscal year forward (Starting the new fiscal year only)

- In case you are using Sage Pro, Premium or Quantum: Ensure that you are logged in as a single user and have administrative rights.

- Create a backup of your data.

- Next Verify the fiscal year information: Select Setup > Settings > Company > Information to view the details.

- Now you need to confirm the current fiscal start and end date.

- Click on Maintenance > Check Data Integrity.

- Ens sure it shows Data OK at the bottom.

- Print out any year-end reports you need.

- Click on Maintenance > Start New Year.

- Click on OK.

- Once prompted to clear old lookup data, Click select No.

- Select the Check List and the To-do list that can appear depending on the settings.

- Click select on Maintenance > Check Data Integrity again.

- Ensure it still shows Data OK at the bottom.

- The user should check Setup > Settings > Company > information again to make sure you have moved your dates forward.

- The current dates should match the new dates

- If the Sage 50 has automatically moved your net loss or profit into retained earnings.

- If you still need to make any adjustments in the prior year, Sage 50 allows you to do this by changing the transaction date to the previous year.

Solution: 2 Change the Session Date

It is possible to move into the New Year by selecting “change the session date” to the first day of the calendar or fiscal year.

- Click Select Maintenance > Change Session Date…

- Now Enter the first day of the new calendar or fiscal year.

- Option to click on the drop-down menu, the last option is the first day of the New Year.

- Go to Sage 50 – New Fiscal and Calendar Year window, and select Yes to make a backup.

- Once the backup is completed, Click select OK on the Sage 50 – this is the Information window that tells you the years were created successfully.

- On the second Sage 50 – Information window, select No when asked if you want to clear the old data.

- Close the Checklist window.

- Close the Daily Business Manager window.

- Now that the new fiscal and or calendar year has started, repeat steps 3 and 4 to verify the data integrity again.

- Note: If an accountant’s copy backup is restored in the accountant’s edition of Sage 50,in this case the company file will be restricted

Also Read : Sage 50 US Payroll & Year-End Processing

Come to End!

Hopefully, the post has proved to be worthy for you while understanding ‘How to Change the Financial Year Start Date in Sage’. Just in case, you are facing trouble while applying the steps to change the financial year start date and looking for assistance, get in touch with our professionals at Accountingadvice.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

Frequently Asked Questions(FAQs)

How do I check that My Financial Year start date is correct in Sage?

Simply, go to the menu bar and then click Settings >>> Financial Year. Here, check out the date whether it is correct or not. If it is not correct then you must first correct it before continuing further.

What are the things you Need to Check before Year End in Sage?

There are few things you must check before the Financial Year End in Sage:

1. Ensure that all outstanding transactions, including any adjustments from your accountant, have been posted.

2. If you usually run at the end of the month, make sure you’ve done it this time.

3. Copies of management reports, such as Profit and Loss and Balance Sheet, should be printed.

What are things that I should check after I finish the Financial Year end Process in Sage?

First, click on the “Settings” and then “Financial year” to verify that the financial year is correct for the New Year:

1. Next thing is to check your brought forward the Trial Balance

2. Check your data

3. Create another backup.

How can the User Change the Financial Year in Sage 200?

In order to do this:

1. Start by Clicking on Settings

2. Next click Financial Year

3. Now click Change.

4. Click on Yes

5. Next click Yes once again.

6. You need to Set the financial year start month as 12 months earlier than the new end date

7. Finally click OK.

How to Change the Accounting Year?

The user can shorten the company’s financial year as many times as you like. The minimum period you can shorten it by is 1 day. This can lengthen the financial year of the company to a maximum of 18 months, or longer in case the administration of the company.

How can One Change the Date on Sage?

In order to do this, you need to:

1. Open: Accounting System Manager

2. Next click on Accounting Periods

3. Now go to Maintain Accounting Periods.

4. Now Select the date to be amended.

5. Finally Click Change Period Date.

How can One Extend the Next Financial Year in case of Tally?

When it comes to Tally, shifting into the new financial year is as simple as changing the date. In order to change the current period:

1. Go to Gateway of Tally

2. Next click F2: Period and enter the dates.

3. This way, you can: Continue to record vouchers in the same company data.

Can the User Extend the Accounting Period?

The first accounting period should be between six and eighteen months. Subsequent periods will generally be twelve months, however it can be changed to anything from one day to eighteen months. An accounting period can also be shortened as often as you like but can only be extended once every five years.

Can a User Change the Financial Year?

Companies are able to only change the FYE for the current or immediate previous financial year.