Set up Late Interest in Sage 50 Accounting

Updated On: June 21, 2023 8:29 am

Sage is a popular business intelligence software that enables users to see how their business is performing in real-time. Recently, there has been a lot of talk about late interest rates and how they are affecting businesses. In this blog post, we will discuss what late interest is and how it can affect your business. We will also provide some tips on how to set up late interest in sage 50 so you can have accurate reporting of your finances.

User Navigation

- How to Set up Interest Charges for Late Customer Payments

- Steps on how to Charge the Customer Interest on Overdue Accounts

- How to Create Interest Invoices for the Overdue Receivables?

- How to Charge the Interest on Overdue Invoices

- Chasing the Late Invoices: How is It Done in Sage

- How to Add or Change Early Payment Terms for the Customers?

- Accounting Professionals & Specialized Experts

- 💠Frequently Asked Questions💠

Sage is one such software that has been considered among the best when it comes to small to big businesses’ financial and accounting-related needs. This is one such software that comprises some of the most well-thought features designed to enhance your overall experiences for better productivity and efficiency, as one might expect. Likewise, the issue of Late Interest is one such aspect that has been addressed in the Sage software. So, what is a ‘Late Interest’ and what can be done about it? That and more on the topic in this article.

How to Set up Interest Charges for Late Customer Payments

To do so, one needs to:

- Go to the Set Up menu

- Navigate over to the Home Window.

- Select Settings.

- Now, click on Customers and Sales

- Next, click on options.

- Now, click on the Interest Charges in the Check Box.

- It is here, that you can select from either the Compound Interest or the One-time Simple Interest.

- The user will need to select either Annual Interest Rate or Monthly Interest Rate when selecting Compound Interest.

- Next, you need to enter the number and date in the ‘Days and Percentage’ boxes.

- The Daily interest rate is calculated based on the Interest Rate that you enter.

- Finally click on OK

Read More-: How to Record Loan in Sage 50

Steps on how to Charge the Customer Interest on Overdue Accounts

So, how do you know what to charge when it comes to the Customer Interest on Overdue Accounts? Well, here are the steps:

- Go to the Customer’s ledger Record

- Here, you need to enter the Interest rate charges

- This will automatically cause Sage 50 to create an invoice according to the Interest charge for the account overdue.

- Go to the Ledger Settings

- Here,enter the Interest rate.

- Now you need to Print statements and create Invoices for the Interest Amounts on the Statement.

- Next, calculate the Interest amount owed and subsequently create the invoice for the Interest amounts on the statements.

- Now, calculate the Interest Amount owed and the subsequent invoice for the same.

- Next Print and Send out the customer statement and also enter the receipts once the Interest charges are paid by the customer.

How to Create Interest Invoices for the Overdue Receivables?

The customer is subjected to an Interest cycle when the Customer’s payment is overdue. This is usually based on the Interest profile that has been defined to him/her in Customer master. However, with the help of Sage, the customer can easily calculate and track the accumulated interest for a certain customer. This is done by a single click that can create an Interest Invoice Batch. To do so, you will need to:

- Go to Accounts Recievable

- Click on A/R Priodic Processing

- Now, click on Interest Batch

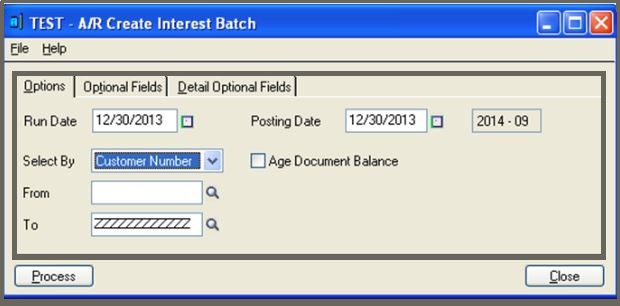

- In the above screen, you can see that one can create batches of interest invoices for a wide range of customer number, Group or the Billing Cycle

- One can easily create a single batch of Interest invoices at a single time, however, one can have multiple batches of interest invoices as required.

- The Run Date: This is the assigned date that you enter as a document date for all the interest invoices in the batch.

- The Posting Date: This is the date that you enter in which you wish to post the interest invoice in General Ledger.

One can select any of the three options:

- The Customer Number: This is to create customer-wise interest invoices

- The Billing Cycle: This is to create the Invoices for the customers that have been assigned to the Billing cycle assigned by you.

- The Customer Group: This option is used to create the invoice for those customers that have been assigned the customer groups that are specified by you.

- The Age Document: This option program is selected when all the transactions are dated after the run date

Likewise, one can also insert the detail level optional field and the header level if required for the interest invoice entry. Once the Process option has been clicked an un-posted invoice entry is created within the AR batch list. Once the entry has been verified, the same can be posted. This is how the Interest Invoices are created for the customers

How to Charge the Interest on Overdue Invoices

In case one needs to understand how much to charge on Overdue invoices, the following steps need to be done:

- One needs to Create a New Sales Invoice for the Interest Amount owed.

- Once the payment has been received for the Interest owed, you need to enter the payment against the Interest Invoice.

- The Interest will continue to be calculated by Sage Software against the overdue original invoice.

- This will continue till the Payment has been received for the same

Also Read-: Credit Card Reconciliation in Sage 50

Chasing the Late Invoices: How is It Done in Sage

Any small time or even a big business owner will understand the importance of Cash Flow. This is an essential feature of any business as it ensures timely payments in order to cover the overheads, to settle the outstanding bills and to be able to pay the contractors and the staff. However, it can be quite a downer, if and when your clients fail to pay the invoice on time. This can effect the cashflow and your chances on a new project as well. So, how do you chase a ‘late invoice’ and how to skirt across the issue? Well, we have some of the top experts from the Sage software to lend us some of the best tips and tricks for the same. Also, it is important to share a handy flowchart that can be downloaded at any time and left for future reference. Speaking about the ‘Flowchart’, according to the experts, this is one of the best infographic timelines of sorts that can be used for chasing late invoices, according to the experts. Also, the flowchart is a great option when it comes to debt recovery in case your client fails to pay you.

Generally, according to the experts, a small-time to average-sized business takes about 71 days per year on admin that also includes the followed-up delayed payments as well. Now, as most experts agree to the fact that this 71 days of ‘chasing the unwanted’ can infact be used to accomplish some productive and constructive work at business. So, how do we deal with this? Read on to know more about how to use the ‘Chase late Invoice’ feature at Sage to cut-down the ‘time wasted’ other wise.

According to experts, to start with you need to get hold of the accepted Business Protocol. With the help of these Protocols one can easily ‘stay professional’ and keep track of the client relationship in a manner it should. This way both you and your client will be allowed ample amount of time to deal with the problem of late payment before the matter escalates to ‘the third-party’ intervention.

Chasing the Late Invoice: How to do it?

So, now that you have well-understood the importance of ‘Chasing the Late Invoice’, let us get into the aspect of how do best do it in a professional manner.

According to the experts, to start with, you need to ensure that you always send out the invoices promptly and ‘agree’ in terms with the clients, as arranged previously. There are times, when the invoices send out are either late or filled with minute errors. Not only does this sound and appears unprofessional, it also gives a ‘bad impression’ about you and your company. To fix, this, start by changing the ‘Invoicing methods’ you have been using so far. The ‘catch’ here is to ensure that you do not give your clients excuses to take even longer on an otherwise ‘delayed invoice’.

As mentioned earlier, the ‘Flowchart’ feature available in Sage offers the perfect summary of all that you need to know of and what you need to take care of in case of a late invoice scenario. The experts often advice on downloading the Flowchart and keeping it handy for quick and easy reference as and when required.

Tips to Follow In Case of Chasing the Late Invoice

As mentioned earlier, Chasing Invoice is not much fun; it being time-consuming is yet another aspect one needs to consider aswell. So, how do you get this done? Well, here are some pointers for the same as recommended by the industry experts:

- To start with, ensure that a proper invoice along with all the rectified details and information as per the terms of agreement has been issued to your customer.

- All the timeline of communication via email, phone calls or any other correspondence should be well-documented properly. Also, be sure to make the right connections, in the right manner with the right person.

- It is important to maintain mentioning the correct facts, meanwhile ensuring that you stay polite at all times.

- One needs to bear in mind to stick to the Sage Flowchart, and used the daily remainders to ensure you stay along the timelines.

- You also need to be aware of the rights bestowed by the government when it comes to charging the interest for any outstanding Invoices.

- One way to get hold of the invoices before they go overdue is to keep reviewing your trade debtors listing on a regular basis.

- One must restore to the Debt collection Agency as the last resort. This is because not only do they take a ‘cut’ of the invoice in question but also causes irreparable damages to the client relationship.

- Intimidate your client about the late payments before you finally engage them with any further procedures regarding the same.

- Finally, take note that there are times when a late payment is simply a result of a ‘human oversight’, and can be rectified by a simple step.

How to Add or Change Early Payment Terms for the Customers?

One can easily do the above by following three ways:

To Add or Change Terms for all Customers

- Go to the Set Up menu

- Now click on the Home Window

- Select Settings

- Next, click on Customers and Sales

- Now, click on Discount

- Go to the Early Payment terms Section

- It is here that you need to change the early payment terms.

- Now click on ok

- And you are done.

To Change or Add terms for a Customer

- Go to the Home Window

- Click on Customer and Sales option

- Now, click on the Customers icon

- Next, double click on the Customer’s name in order to open their records

- Go to the options tab

- Go to the Early Payements Terms Section

- It is here thst you need to enter:

- The Discount rate

- The number of days when the invoice needs to be paid in order to receive the discount.

- The number of days within which the full amount of the invoice needs to be paid.

- Now go to the File menu

- Click on Save

- Finally close the Customer Record

To Add or Change the Terms on the Customer’s Invoice

- Start by entering the Sales Invoice

- Based on the payment method selected by you, various methods can be used to enter the payement terms or the early-payment discounts.

- To Pay later: Go to the Terms box and Add or change the early-payment terms

- For Cash, Cheque or Credit Card: Go to the early Payment Dscount box and enter a percentage rate.

See More-: Sage 50 US Payroll Reporting for the CARES Act HR 748 Paycheck Protection Program

Conclusion

So, there you have it people, these are some of the facts, tips, tricks and features when dealing with the Late Interest In Sage. Be sure to follow each of these steps accordingly, however in case of any further doublts, be sure to reach out to us through any of the channels provided and we will be more than happy to help you out.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

💠Frequently Asked Questions💠

How to Add Interest in Late Payments?

This can be easily done by multiplying the number of days in which the payments have been late with the amount of the debt. This needs to be further multiplied by the daily late payment interest rate in operation on the date the payment grows overdue.

What is meant by Late Interest?

This is known as the additional interest that is charged by the Equitable on both the Interest and the Principle portion. This also includes the interest accrued on the fees or the other charges related to any late Regular Payment. The late Interest are charged accoridng to the Interest Rate.