Correct a Posted Receipt in Sage 50 Error

Updated On: May 12, 2025 11:23 am

When you get a receipt in Sage 50, it’s important to make sure that you correctly post it. Otherwise, you may end up with errors and incorrect information. In this blog post, we will show you how to correct a posted receipt in Sage 50 error.

User Navigation

Sage 50 is a popular accounting software that helps businesses perform their accounting activities more efficiently. It is also highly appreciated for its user-friendly interface. Even a novice accountant can operate this platform quite easily.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

We keep getting quite a few questions from the users of Sage 50, based on their experiences with this software. One of the users recently informed us that he posted a transaction and it included some errors and he wanted to correct it. We understand such inadvertent errors are quite normal in any accounting activity, but, if not corrected in time, they may do more harm than good. Therefore, in this blog, we would be talking about how to rectify or edit a transaction (Sales Orders, Receipts, Journal Entries, Purchase Invoices, Paychecks and so on) already posted in Sage 50. We will also discuss other associated matters. You simply need to flip through this blog till the very end.

Also Read: How to Reverse an Incorrect Journal Entry on Sage?

Here we go!

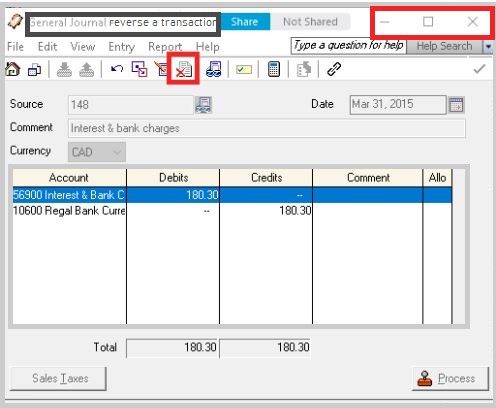

How to Reverse a Transaction in Sage 50?

Please perform the steps below:

- Open the Sage 50 application

- Locate the transaction you wish to reverse

- Open the transaction

- Click on Entry

- On the toolbar, click the Reverse Entry tab

- Verify that the transaction is not affecting your account balances

Please Note: A transaction will have the reverse transaction button, provided it is already posted.

How to Reverse a Customer Receipt in Sage 50?

Please perform the steps below:

- Open the Sage 50 application

- Click to open the Receivables (Customers & Sales) module

- In the Home window, click on Receipts

- Click on the From drop-down box and specify the customer for whom you want to reverse the payment

- Click on Receipts and click on Include Fully Paid Invoices / Deposits, if you have paid the invoice in full

- Alter the Paid By box to Cash

- Make the Deposit to box to choose the correct account where you want to record the reversal

- Add additional information to the receipt number

- Alter the date to the one when your bank reversed the deposit

- Click on the Amount Received column

- Enter the amount as a negative quantity, where the invoice appears

- Type in any Comment, if needed

- Click on Process/Post

Also Read: How to Fix Sage 50 Invoice Error?

How to Reverse a Vendor Payment in Sage 50?

Please perform the steps below:

- Open the Sage 50 application

- Click to open the Payables (Vendors & Purchases) module

- In the Home window, click on Payments

- Click on the to the order of drop-down box and specify the vendor for whom you want to reverse the payment

- Click on Payment and click on Include Fully Paid Invoices / Prepayments, if you have paid the invoice in full

- Alter the Paid By box to Cash

- Make the Form box to choose the correct account where you want to record the reversal

- Add additional information to the receipt number

- Alter the date to the one when your bank reversed the payment

- Click on the Payment Amount column

- Enter the amount as a negative quantity, where the invoice appears

- Type in any Comment, if needed

- Click on Process/Post

Is There Any Difference Between Reversing and Deleting a Transaction?

Yes. There is one important difference between the two. When you delete a transaction, it gets deleted completely from the system. However, if you reverse a transaction, the system would preserve an audit trail for the said transaction. Please note that you cannot delete a transaction in Sage 50.

Final Words

We hope, after going through the blog, you have received a fair idea of how to rectify or edit receipts and transactions already posted in Sage 50. If you have any more queries related to it, you may get in touch with some experienced Sage professionals.

Frequently Asked Questions:

How to Delete a Transaction in Sage 50?

Please follow the steps below to delete a transaction in Sage 50-

1. Navigate to the Task Menu

2. Click on Edit Register

3. Now, click to select the relevant bank account

4. Click Ok to proceed

5. Now, to delete a transaction, locate it in the row that is matching with the transaction

6. Click to select the transaction to delete

7. You will see a black arrow for this transaction

8. Right-click on it

9. Now click on the tab named Delete Row

10. A prompt will pop up. Click yes to delete

11. Select Finish

12. Click on the Start Button to print the journal or to save it as a file

13. You can post the reversing entries in Cash Management, with the General Ledger in Accounting.

14. Once the entries are deleted, you may need to delete the bank balances as well

How to Void or Reverse an Inventory adjustment in Sage 50?

You will need to follow the steps below for void or reverse an inventory adjustment in Sage 50:

1. To reverse the original entry, you will need to post another inventory adjustment with the opposite quantities and values. You will find these values in should see the reports mentioned in the previous section.

2. If needed, you can post another inventory adjustment, along with the changes desired.

What is the Error Code 12 Invalid Transaction?

Sage Error Code 12 Invalid Transaction is one of the ‘decline errors’ related to transactions and payments. Whenever users come across a decline error, they should assume the error is one relating to financial institutions.

You may come across this error when you are using a credit or debit card to make a payment through the Sage platform. When this error occurs, you will receive an error message that your transaction has been denied and your bank is not willing to process the concerned transaction.