Sage Payroll Services

Are you looking to take advantage of payroll services for your small business but don’t know where to start? Sage Payroll Services is here to help. This comprehensive guide will provide a full overview of all the features and benefits of using Sage Payroll Services, so that you can make an informed decision about what’s best for your company. We’ll start with a brief overview of the different types of payroll services available and why Sage is one of the most popular options available.

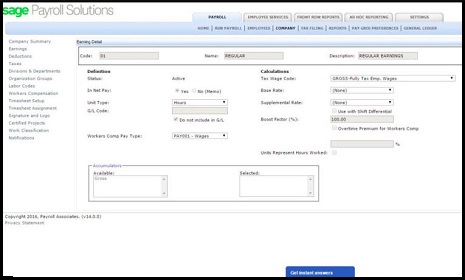

User Navigation

We’ll then look at some of the key features, such as payroll processing, tax compliance, mobile apps, and self-service options. Finally, we’ll discuss the prices and plans offered by Sage Payroll Services and how they compare to other providers’ offerings. Let’s get started!

Sage is one such accounting and finance-related software that has grown in massive popularity in recent times. The various ease-based features of Sage make it much sought after as people with no financial knowledge or know-how can also make the most out of the software. Some of the most remarkable features of Sage are

- Multiple options in Integration

- Can be accessed through mobile, desktop and also Cloud

- Is suitable for both small and big businesses alike

- Comprises of one of the best Reporting Features

- Offers Multiple Functionality

- Also, offers Free Trial

Of these, it is the sage payroll services that are also much appreciated.

About the Sage Payroll

The Sage Payroll is a Cloud-based software, that offers services for businesses of all sizes. Not, just that, but also there are additional advantages of the software that helps enhance productivity like Accounting Integration, Tax Filing, and HR Data Management. The best part about the Sage Payroll Service is that it comprises three different plans and options that have customized Pricing according to individual requirements.

Read More-: Is Sage Payroll Like QuickBooks

The Basics of Sage Payroll Services

The best part about Sage Payroll Services is that it is a cloud-based software. This implies the fact that one can easily access the system ‘ on the go’ and from practically any device with the basic requirements in them. This way one can easily manage and automate the Payroll process efficiently from wherever you are. One of the most remarkable ‘takeaways’ from Sage Payroll Services is that you can ensure that the employees are paid on time, through various platforms like business-generated checks or even Pay cards.

Likewise, one can file taxes and maintain compliance up-to-date. Also managing the employee data is a breeze. The other main aspect of the Sage payroll Service is that it has the capacity to be able to integrate a wide range of various software that features Time Management, HR Management, Accounting and also Payments. Finally, worth mentioning is the aspect of the services like the Customer Support services, the Sage Advice Community and the six-month-money-back guarantee.

The Various Features of the Sage Payroll Services

Firstly, the features and the various aspects of use of the software greatly depend upon the Plan that has been selected by the user. The three plan options include

- The Sage Payroll Essential

- Sage Payroll Essential Plus

- Sage Payroll Full Service

The Sage Payroll Essential

This is the basic plan and comprises the payroll software plan that ranges from “I want to do payroll myself” to “I want someone to do payroll for me.”This particular essential plan falls within the ‘I want to do Payroll myself’. One can easily use the Cloud platform to receive payroll services.

With the help of this plan, the user can easily pay the employees automatically according to the Payroll Schedule. One can use direct Deposit, print your own checks, or even use Pay cards to pay the employees directly. In order to set up the payroll under this plan, one needs to manually enter the business and Employee information and data as and when required. Once done, it becomes a breeze to be able to access all the required payroll data from a single platform. Likewise, the employees can also integrate the payroll platform with various software like ACA management, Time Management, Payment Processing, and also Human Capital management tools

The Sage Payroll Services includes various additional features like comprehensive payroll reporting, a support group and also six-month-money back guarantee.

The Sage Payroll Essential Plus

This is the next plan that one can make the most of from the Sage Payroll Services. The special feature of this particular plan is that it falls more on the ‘essential’ aspect of the feature. The plan is rather a comprehensive one and includes everything from the ‘Sage Payroll Essential’ along with the addition of having the option to include the tax filing within your plan.

The Sage Payroll Full Service

As the name suggests, this is one of the most ‘complete’ of the Sage Payroll Services plans. This is more on the ‘I want someone to do payroll for me’ aspect of the plan. The best part about this plan is that the software itself takes charge of all the aspects of the Essential and the Essential Plus plans, mentioned above.

One of the aspects worth the mention is that the user is ‘offered’ a representative that offers support for their specific needs and to set up your payroll. Along with the payroll processing services within the previous plans, Sage will also file and remit the taxes within all States and Jurisdictions. Finally, the additional HR data management is also the ‘cherry on top’ of the Sage Payroll Full service.

Also Read-: How to Delete a Payroll Instead of Voiding it at Sage 50

Additional Aspects of the Sage Payroll Services

Other than the three remarkable payroll plans included, the Sage services also has some additional features included

Sage Payroll HCM

This particular feature is an additional extension of the Sage Payroll Full Services. This comprises all the features of the Sage Payroll services along with the Human Capital Management System tools also. This comprises Hiring, Recruiting, onboarding employees and more. The best part about the Sage Payroll HCM is that it offers access to career job portals that allow a better job management description and also to view the candidate profiles. One can easily create or publish multiple jobs in various job search platforms, manage applications, and also to generate reports.

Once the user has decided upon the process of hiring, they can easily use the software for the process of onboarding the new employees. This allows them better access to training, manuals, employment forms and also customizable workflow templates

The Sage Payroll Pricing

Sage is a quote-based software, hence the price of the plan greatly depends upon the plan, the size of the business, the ‘Plan’ that you have selected, the payroll schedule, and various capabilities and integrations that are needed for the process of purchase. However, it has been recommended, that the user directly contact Sage support to be able to find the price as per the specific business needs.

See More-: Sage 50 US Payroll & Year-End Processing

Conclusion

So, there you have it, people, these are some of the major aspects of Sage Payroll Services and the various features associated with it. However, in case of any further doubts, you can easily get in touch with our team of experts and we will be more than happy to assist you.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

Frequently Asked Questions(FAQs)

What is Sage Payroll Services?

Sage Payroll Services is a comprehensive payroll solution that helps businesses manage their payroll processes more efficiently. It offers a wide range of features and tools to streamline payroll management, including employee self-service, direct deposit, tax filing, and more. Sage Payroll Services also offers robust reporting and compliance features to help businesses stay compliant with government regulations.

How to Set Up Sage Payroll Services

To set up Sage Payroll Services, you’ll need to create an account and then follow the on-screen instructions. Once you’ve logged in, you’ll be able to add employees, set up payroll schedules, and run payroll reports.

If you’re not sure where to start, we’ve put together a step-by-step guide on how to set up your account and get started with Sage Payroll Services.

Follow these steps to get started:

🔹 Go to the Sage Payroll Services website and click “Create an Account.”

🔹 Enter your personal information and click “Submit.”

🔹 Follow the on-screen instructions to complete the account setup process.

🔹 Once your account is created, log in and click “Add Employees.”

🔹 Enter your employee’s information and click “Save.”

🔹 To set up a payroll schedule, click “Payroll Schedules” from the left menu and then click “Add Schedule.”

🔹 Enter the schedule details and click “Save.”

🔹 To run a payroll report, click “Reports” from the left menu and then select the type of report you want to generate.

What to Look for When Choosing a Sage Payroll Service

There are a few key things to look for when choosing a Sage Payroll Service. The first is that the service should be able to integrate with your current accounting software. This will make it much easier to keep track of your payroll and avoid any errors.

🔹 Another important thing to look for is whether the service offers direct deposit. This can be a huge time saver, especially if you have employees who are paid on a weekly basis. Direct deposit also ensures that your employees will always get their paycheck on time.

🔹Finally, you’ll want to make sure that the Sage Payroll Service you choose offers customer support. This is important in case you have any questions or run into any problems. A good customer support team will be able to help you resolve any issues you have and make sure that your payroll runs smoothly.