Sage 50 Corporation Tax Error 9288

When submitting the CT600 return, if the user is claiming the Annual Investment Allowance for more than £200,000 cap, the HMRC server will reject the submission with an HMRC validation message, which is as follows:

User Navigation

- Error Number: 9288

- Error Type: Business

- Error Text: The sum of Boxes 690 and 735 must not exceed the apportioned AIA limit

Many users have reported that they have faced the Sage 50 Corporation Tax Error 9288 while filing their taxes. If you are also troubled by this issue, we can be of great help. In this blog, we will look at how to fix this issue once and for all.

What is Sage 50 Corporation Tax Error 9288? What Causes this Error?

This Sage 50 Corporation Tax Error 9288 is primarily a validation error linked to the AIA (Annual Investment Allowance) Limit. This is the limit you can deduct from your total profit and the deduction needs to be made before you file the tax. All such deductions need to be shown properly on the tax form.

Sage 50 gives you the option to set the AIA Limit. Please note that, if you wish to increase this limit, you can do this by going to the settings for the AIA. If you specify an AIA amount more than the previously set amount, the Sage 50 Corporation Tax Error 9288 occurs. As a result, the Corporation Tax is not recorded properly.

In the Autumn Budget 2021, the annual investment allowance has been extended by HMRC with a provisional £1 million cap till 31 March 2023. This extension of the temporary £1 million cap was initially due to revert to £200,000 as of 1 January 2022, but this will now happen on 1 April 2023.

Nevertheless, HMRC has yet to update its servers with the extended amount of £1 million cap. Therefore, for any submissions that have been made with the Annual Investment Allowance claim of more than £200,000 cap, the above error will be offered by the HMRC servers till they get updated with the extended limit.

Solution:

HMRC has informed the users/clients/customers that the Corporation Tax online service will be updated to reflect this change by 30 June 2022. Hence, once the HMRC updates its servers to reflect the extended limit, the user can submit your return with the said extended limit.

Need Experts Help-: How to Fix Sage 50 Error 3001

How to Fix Sage 50 Corporation Tax Error 9288?

Please note that this Sage 50 Corporation Tax Error 9288 is specific to a certain Sage version. You can easily fix this error by installing the latest updates for your versions, released by Sage 50 from time to time.

Please follow the procedure below to uninstall your current Sage version and install an updated version of the Sage 50 software –

- Log in to Windows with admin credentials

- If you are using Windows 8.1 and lower, locate Programs and Features. Then click Control Panel >>Start

- If you are using Windows 10, right click on the Start menu. Then click on Programs and Features >> Apps and Features

- Select the Sage 50 version you are using, from the list

- Click on Uninstall

- Now you can install Sage 50 by downloading the updated product from Sage 50 Product and Payroll Updates

- If a previously downloaded installation file exists on your system, browse to C:\Sage\Sage 50 Accounting Installer files 202*.*

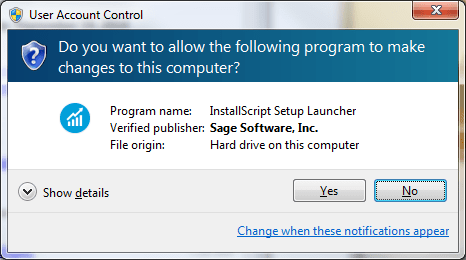

- Do a double click on the launch.exe file to begin the installation process. You will get a prompt like-

- Click on the Yes tab to continue

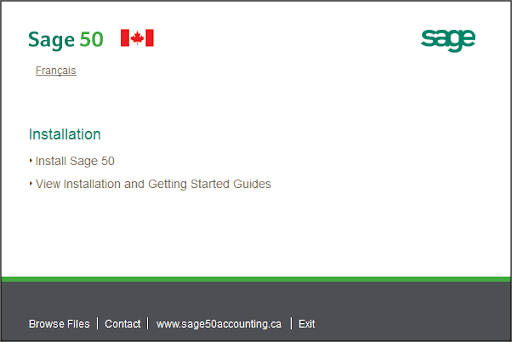

- The Sage 50 Install Shield wizard will come up

- Click on Next to continue.

- On the next screen, click Install Sage 50

- Choose your language

- Click OK

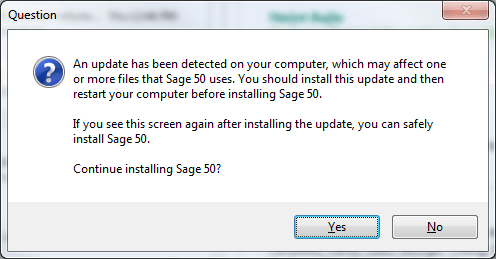

- You will get a prompt, asking if you want to go ahead with the installation

- Select Yes

- If Windows Firewall is enabled, you will receive another prompt, asking if you want the Firewall automatically configured for the Sage 50 software.

- Select Yes to proceed

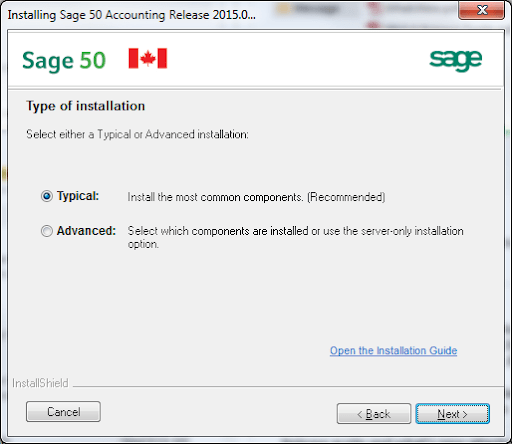

- Choose your preferred installation type

- If you have already installed a previous version of Sage 50:

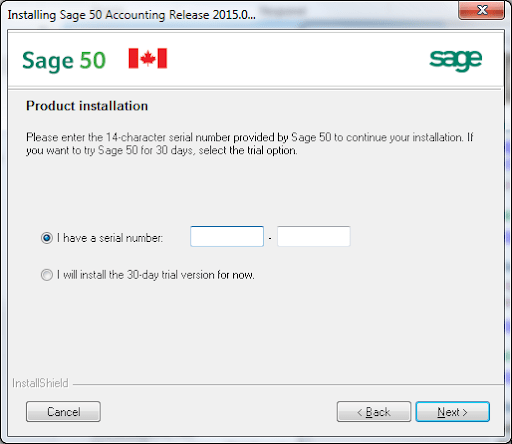

- The installer will automatically retrieve the activation codes, provided the computer is connected to the internet.

- Click Next to continue.

- Select No thanks if you need manual activation and want to enter your serial number yourself

- Click to accept the terms & conditions of the license agreement

- The Install Shield Wizard will initiate the installation

- After the installation is complete, a confirmation message will appear

- Select Finish

- Open Sage 50

- Check if you are getting the error message again

The troubleshooting methods mentioned above should help you to fix the Sage 50 Corporation Tax Error 9288 on your system.

HMRC Submission Errors

An error might appear when you make submissions to HMRC from Sage 50 Payroll. We know this can get quite annoying, especially if you do not know the reason.

To assist with this, here are listed below the errors that can appear:

The Solution

Common Errors

Here are some error codes and messages below:

|

Error Number |

Description |

|

Authentication Failure. The supplied user credentials failed validation for the requested service. |

|

|

4999 |

Internal schema validation error. |

|

5045 |

You have already filed an original return |

|

7801 |

Accounts Office reference or Employer PAYE reference is incorrect |

|

7802 |

You have not been invited to submit this submission type |

|

7804 |

This submission cannot be accepted as a Full Payment Submission has not been received and successfully validated for this scheme reference. |

|

7805 |

Service currently unavailable |

|

This submission cannot be accepted as it does not fall within the eligible filing period. |

|

|

7808 |

This submission cannot be accepted as an Employer Alignment Submission is required for this Employer Reference. |

|

7811 |

This submission cannot be accepted as alignment has commenced or successfully completed. |

|

7841 |

No starter form provided. |

|

7866 |

Error 7866 – The amount in [EMPLOYEESCONTRIBUTIONSON ALLEARNINGSYEARTODATE] must be 0.00 if the [NILETTER] is ‘X’, ‘C’, or ‘W’. |

|

7918 |

This error occurs if you try to send an Employer Payment Summary (EPS) submission for a period that HMRC no longer accepts. The deadline for each tax month’s EPS is the 19th of the next month. Find out more about how to submit an Employer Payment Summary (EPS) > |

|

7927 |

The entry in [TAXMONTH] of 12 is only valid if the submission is made between 6 February and 19 April inclusive of the [RELATEDTAXYEAR]. This message can occur in any tax month. |

Also Read-: How to Fix Sage 50 Error 3318

Conclusion

Sage 50 Corporation Tax Error 9288 is a relatively common issue when filing taxes. Fortunately, this error can be easily fixed by following the steps outlined in this article. If you are still experiencing difficulty or need further assistance with your tax returns, it is always recommended to consult an accountant or a qualified tax advisor for professional support and advice. By understanding what causes Sage 50 Corporation Tax Error 9288 and knowing how to resolve it, you will save time and energy during the filing process.

Accounting Professionals & Specialized Experts

Want quick help from accounting software experts? Get in touch with our team members who can install, configure and configure your software for you. Proficient in fixing technical issues, they can help you quickly get back to work whenever you encounter an error in Sage software. Our team is available 24/7 365 days to assist you. To get in touch.

Frequently Asked Questions(FAQs)

How does the Sage 50 Software Calculate the AIA (Annual Investment Allowance) Limit?

You can calculate the total AIA by the guidelines provided by the HMRC. Normally, while calculating, you will obtain an amount close to 200,000. The Sage 50 software can calculate this amount automatically and can save it. If, later on, you enter an amount more than this amount in any tax form, the Sage 50 Corporation Tax Error 9288 would occur.

How can I Download and Manually Install the Sage 50 2022 Payroll Tax Updates?

Here are the steps to install the Sage 50 2022 Payroll Tax Updates–

🔹 Navigate to Reports And Forms

🔹 Click on Forms

🔹 Choose Tax Forms

🔹 Open the Payroll Tax Forms section

🔹 Open your preferred tax form

🔹 A prompt will ask if you want to install the tax updates

🔹 Click on the Download Updates tab

🔹 After the download gets completed, click on the Run Update tab

🔹 The installation process of the latest Sage 50 2022 payroll tax forms will commence now

🔹 You will receive a prompt. It will ask if you want to go ahead with overwriting the existing files.

🔹 Click Yes to All

🔹 Follow the instructions on your screen and wait till the installation gets completed

I am Asked to Reinstall Sage 50 to Fix the Sage 50 Corporation Tax Error 9288. Can I Install it on Multiple Computers?

Yes. You can do it. Simply purchase a user license for each of the computers where you need to install the software. If you are a SAN member, you can purchase any number of licenses between 2 to 40.